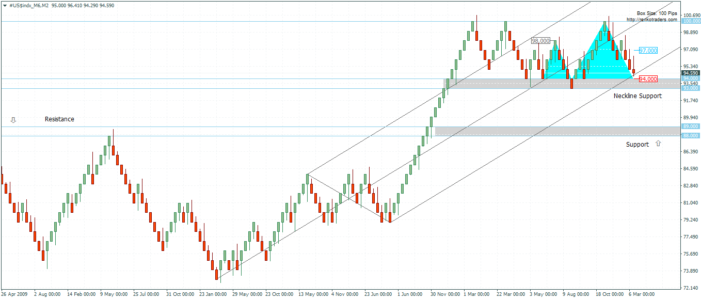

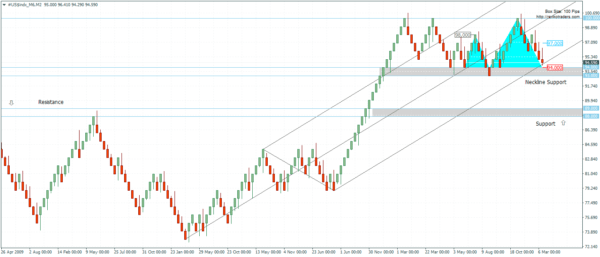

The US Dollar Index has been in a prolonged and a steady uptrend over the past couple of years. However, in recent times, price action has turned flat with the psychological level of 100 turning out to be stronger than expected. Multiple attempts to break out above this level has failed. In the 100 Pip Renko box for example, we can see that the US Dollar Index attempted to test and break the 100 level three times, failing miserably. The most recent test to 100 saw prices decline strongly.

On a fundamental level, over the past few weeks we have seen that the Dollar has turned particularly sensitive to the central banker’s comments with the Dollar posting strong moves. While last week the US Dollar fell sharply on Janet Yellen’s comments, it was the previous week which saw the Dollar move back strongly on other Fed member’s hawkish comments. So far, the markets have realized that the Fed’s rate hike cycle will be gradual and slow at best. Meaning that despite pricing in two rate hikes in 2106, the Fed will most likely take a cautious approach.

On Friday, the US jobs report showed a mixed picture. The unemployment rate increased from 4.90% to 5.0% but the participation rate improved. Average wages also increased modestly all good for inflation to rise. The Fed’s next meeting is due in April (26/27) but it does not have any press conference. It is expected that the Fed will hold rates steady in April but June when they meet next will be the big event to watch for.

US Dollar Index – Renko Analysis

The 100 Pip Renko chart for the US Dollar Index shows the rather flat sideways price action forming currently. Interestingly, there is a potential for a head and shoulders pattern to form with the neckline support established at 94 – 93 levels.

If the Dollar index manages to bounce off the 94 level of support, we can expect to see a modest rally taking shape, which should technically stall near the 98 level, or at the very least not move above the 100 resistance that has been established. Forming the right shoulder here and a following decline back to the neckline could see the US Dollar potentially look for a decline towards 89 – 88 level to complete the head and shoulders pattern. The measured move target of 88 – 89 coincides with a previously established resistance level that was broken. A drop back here could see support being established ahead of what could be a new leg in the rally.

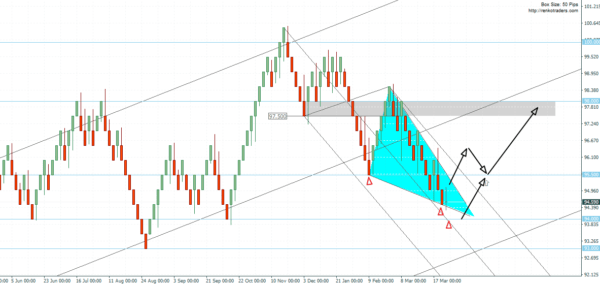

When looking at a smaller Renko box of 50 Pips to see what’s really going on, we can see that the US Dollar index is currently moving in a downtrend, but within a descending triangle pattern. An upside breakout from here could see the US Dollar Index move towards 97.5 – 98.0 level, which sits close to the left shoulder’s peak. However, we need to see evidence of a move to the upside because as of now, price continues to form lower lows. If we see a decline to 94, the descending triangle will be redrawn but it only gets steeper, keeping the short term upside bias intact. The Dollar Index needs to break above 95.5 – 95.0 level and potentially pullback and make a higher low in order to ascertain this bias.

In conclusion, here’s what to expect in the US Dollar Index over the course of the next few months

- Selling USD crosses right now is not advisable as the current declines are nearing their end

- Rather, if you prefer to trade counter trend, look to build long positions on the US Dollar for the short term as most USD crosses will show a pullback to the trends (AUDUSD, EURUSD, USDCAD)

- For the longer term traders, use these pullbacks to add to the short USD cross positions

- The trigger for the near term rally in the US Dollar index is to watch for a reversal near 94 – 93 for a move to 97.5 – 98

- And in the longer term, look for a reversal near 97.5 – 98 for a move lower to 94 – 93 and eventually to 88 – 89