Last week’s trading was mixed with a lot of key economic events that were shaping the markets. Although the U.S. markets got off to a slow start, the week was marked by the swearing-in ceremony of the 45th President, Donald Trump on Friday. The markets did not react much to the event but the U.S. dollar was trading mixed in the earlier part of the week. The greenback initially weakened after Trump, in an interview with the Wall Street Journal briefly spoke about the U.S. dollar being too strong. This sent the dollar falling sharply on Tuesday.

However, the greenback reversed the losses after the Fed Chair, Janet Yellen was hawkish on the U.S. economy as she said that the Federal Reserve was looking for further rate hikes in the coming years. The dollar reversed the gains trimming most of the losses from the previous day on Trump’s comments.

On the economic front, data this week shows that the U.S. consumer prices rose 2.1% on a year over year basis, pushing inflation into the Fed’s inflation target rate above 2.0%. It was good news for the U.S. dollar but the CME futures fed funds probability tool showed a probability of only 29% rate hike in March. Meanwhile in other parts of the world, the Bank of Canada’s monetary policy did not see any changes as interest rates were left unchanged at 0.50%. However, during the press conference, BoC Governor Poloz did not rule out further rate cuts if downside risks materialized.

The European Central Bank’s meeting last week saw the key interest rates left unchanged. ECB President, Mario Draghi told reporters in the press conference that the ECB will maintain its QE purchases until end of December and it could extend QE even further despite recent signs of pick up in the Eurozone inflation. Data earlier in the week showed that inflation rose 1.1% on the headline in the euro area.

Technical Outlook

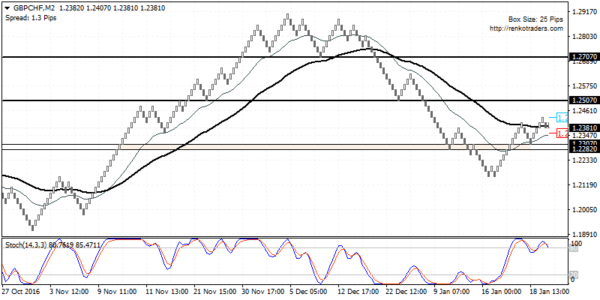

GBPCHF: The British pound has been posting a steady increase over the past few weeks with prices recently topping out near 1.2432. There is scope for further upside in GBPCHF with the recent declines likely to see a correction towards 1.2307 – 1.2282. As long as support is formed here and prices do not dip further, expect GBPCHF to resume the upside continuation towards the first resistance level at 1.2507 followed by a longer term correction towards 1.2707. Bear in mind that the current trend remains down with the 20/50 EMA’s staying bearish alongside the Stochastics posting a hidden bearish divergence.

EURGBP: The euro has been weaker against the British pound after falling below the resistance zone of 0.8767 – 0.8742. The breakout from the rising median line signals further downside continuation towards 0.8517. However, the moving averages signal the uptrend that is in place and the Stochastics shows a hidden bullish divergence with the oscillator making a lower high against the higher high in price. Note that this is also supported by the 50 EMA at 0.8617. Therefore, expect EURGBP to retrace some of the declines as price is likely to retest the resistance level near 0.8747 – 0.8767 region ahead of further declines to the downside.

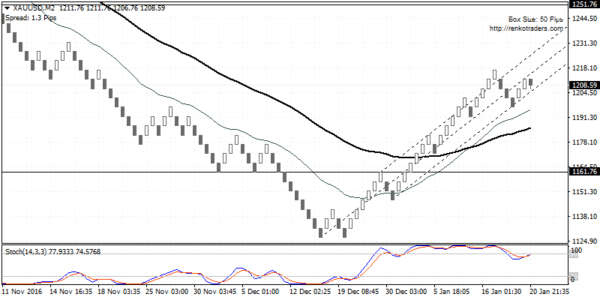

XAUUSD: Gold prices are likely to post a correction with the current uptrend showing exhaustion. This is seen by the bearish divergence that we notice on the chart as gold prices form a secondary high against the Stochastics oscillator’s lower high. Also the median line retest is showing a reversal on failure to breakout higher. Support to the downside is seen at 1161.76. Note that the longer term trend in gold is to the upside which will see gold prices potentially rally towards 1251 – 1250 in the short term if support is found at 1161.76.

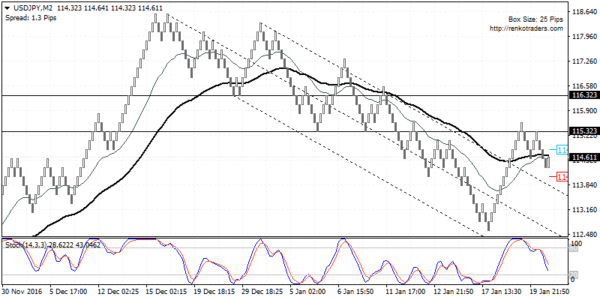

USDJPY: The U.S. dollar was weaker against the yen but there is scope for price to retrace the declines posted. The current trend is bearish with the 50/20 EMA’s signaling a continuation to the downside. However, watch for a lower low to be formed if price declines further. This is also validated by the breakout from the falling median line. If support is formed on a lower low, expect USDJPY to post gains towards 115.32 initially followed by a stronger rally towards 116.32 where resistance can be established.

Fundamental Outlook

The week ahead will be an important one for the British pound. After last week, the British Prime Minister gave her vision of Brexit on Tuesday, this week, the UK’s Supreme Court will be giving its ruling on whether the UK government must first put the Brexit referendum to a parliamentary vote. Chances are that the Supreme Court will rule in the favor of the judgement given by the UK high court which was appealed by the British government last year.

Expect to see some short term volatility in GBP crosses as a result.

On the economic front, this week will see the inflation reports coming from Australia and New Zealand. Economists are expecting to see a mixed report from both the countries which will be in stark contrast to the strong inflation figures seen in the U.S., UK and the Eurozone last week.