The U.S. dollar continued its upside gains last week despite a short trading week. The gains came on a hawkish FOMC meeting minutes which all but signal a rate hike in December.

Data from the US continued to surprise to the upside with the latest durable goods orders posting strong gains. The dollar maintained decent gains but is showing signs of exhaustion near the top and with no support being formed, there is a risk of a strong pull back in the near term.

The euro and gold prices continued to fall as a result of a strong US dollar but by Friday we could see some evidence of a reversal. Nothing is confirmed as of yet and there is scope for price to whipsaw near the current levels before pushing higher.

Technical Outlook

EURUSD continued to push lower last week but the price action is showing signs of a short term correction that we have been expecting for a week now. In the near term, watch for EURUSD to dip back to 1.0577 – 1.0572. On the 10 pip Renko chart for EURUSD, we see price finally reversing of the mid-price channel followed by an eventual breakout thereafter. Expect a reversal near 1.0577 – 1.0572 as EURUSD could be seen posting gains towards 1.0737 or rounded to 1.0725. Note that price has not tested 1.0500 support level and there could be a risk of a downside break.

USDJPY continued to push higher and is now within reach of 114.00 resistance level. Short term support is established at 112.73. Therefore, look for a break down in USDJPY below 112.73 for a move towards 105.23 support level which will be the first point of support in the downside correction. Alternately, if USDJPY does not reverse near 114.00 but instead breaks below 112.73, then look for a retest of this breakout level to go short, targeting 105.23.

EURCAD is showing signs of upside potential after forming a double bottom near 1.4214 marked by a breakout from the falling median line. Look for a near term retracement to the downside within the region of 1.4289 – 1.4214 for a potential reversal. A breakout then from above 1.4289 will see EURCAD potentially rally towards 1.4614 or rounded off to 1.4600. This will most likely be a counter trend move therefore caution should be applied. Above 1.4614, look for further gains that will carry EURCAD to 1.4845.

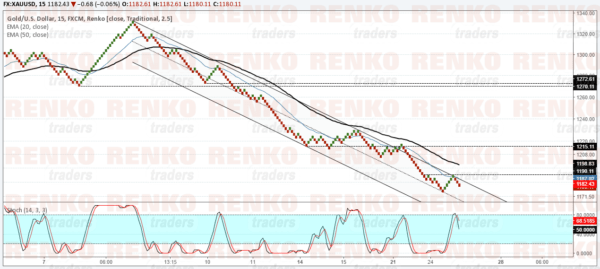

Gold prices could be coming into some strong gains as price is seen making a reversal near the 1170 region. Look for gold prices to breakout above 1190, which will see further upside extend the gains to 1215 followed by an eventual rally to 1270 – 1272. The upside bias could be under pressure if gold prices slide back and break the previous low at 1175.11

Fundamental Outlook

The week ahead is relatively slow but from Wednesday the pace of economic data will pick up steam with a new trading month. China will be reporting its manufacturing PMI figures and later in the day, the ADP payrolls report will be coming out as well. Thursday will see the ISM manufacturing PMI numbers which is expected to rise for a third straight month.

The data culimnates with Friday’s nonfarm payrolls report which is more or less likely to cement expectations for a Fed rate hike in December. Overall, the economic calendar this week looks to be largely in support of further US dollar strength, but with the technical analysis showing a different picture from the fundamentals, we could expect to see some shocks in the market.