Donchian channels come under the channels based indicators, similar to Bollinger Bands, Envelopes and differ slightly in the way the channels are constructed around price.

The fact that Donchian channels offer are more distinctive view of support and resistance, makes it a preferred choice of trading with channels and essentially trumps other channel based indicators.

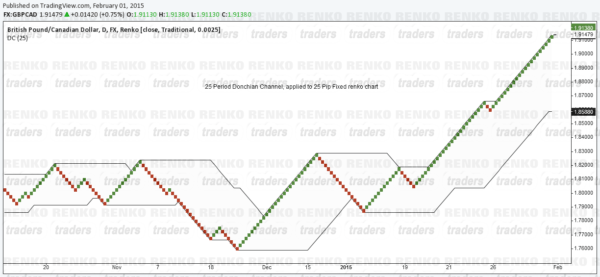

For the Renko – Donchian channel trading system, we simply apply a 20 period Donchian channel to the Renko charts. Or one could just tweak the Donchian channel to reflect the Renko box size being used (if you are one of those who prefer to trade with a fixed box renko charts).

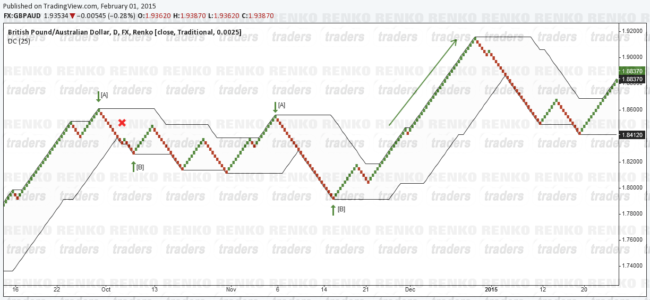

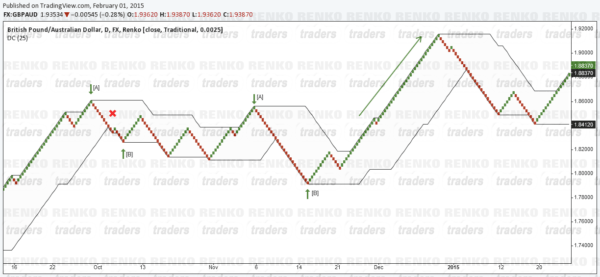

The follow chart illustrates how the Renko – Donchian trading system looks like.

Renko Donchian Strategy Rules

Before we go into the long/short rules, an important aspect to bear in mind is how the Donchian channels align themselves. This aspect forms the most important part of trading with Donchian channels and renko charts. The chart below illustrates the set up.

The pattern we look for here is the A – B bounce and we position ourselves to take a position in the side of A.

In the chart above, from the right, we notice the first A – B set. Here A forms a top and B forms a bottom. So, typically a long position is taken on break out of A. Moving to the left, the second trade shows a similar A – B pattern, but this time reversed. Here, A is to the downside, so a break out of A initiates a short position.

And finally, the left side of the chart depicts an invalidated A- B pattern, where price failed to break below A. Also notice that the rules of this system kept us out of the trade on the false break out from B.

Another factor to bear in mind when trading with the Donchian channels being that we expect the channels to form a horizontal line when the contact points A and B are made.

In terms of stop losses and take profits, the initial trade comes with a stop loss 2 renko boxes below entry. For take profit, we leave it open until we notice at least 2 confirmed bearish Renko boxes.

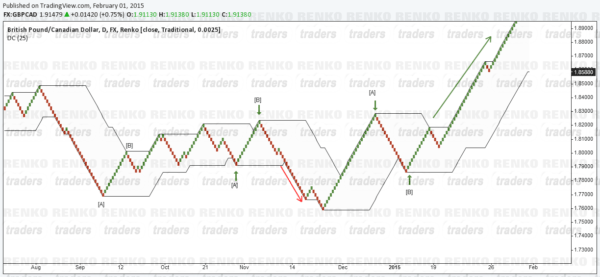

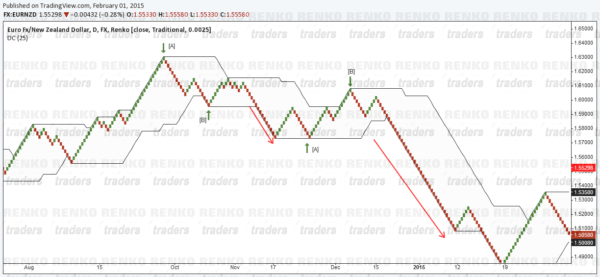

Some more trade examples using the Donchian Channels on Renko Charts

The chart above gives an example of the Short set up where we notice the first trade on the left being a false call due to the failure to break out from the highs of A. To the right of the chart, we notice the A – B pattern which in this case resulted in a break down of price from A’s low resulting in a very decent profit.

The next chart shows a few examples of the long set up. Again to the left we have a failed pattern as price did not break higher from the point A. Moving to the right of the chart, we notice the A B pattern being formed with price breaking out from the previous A’s high resulting in some decent profits.

Effectiveness of the Renko Donchian Trade System

The Renko charts and Donchian channel trading system is a simple way to trade break outs based on the A B patterns. In terms of the Risk Reward, this strategy offers higher profits while ensuring that losses are limited to no more than 50 pips for a trade (with the take profit clearly meeting at least 100 pips per move at the minimum).

The only catch, with this trading system is the fact that traders need to have a lot of patience not only waiting for the right set up (the A B pattern) but also waiting for a break out of A (which may or may not happen).

All charts by Tradingview. Click here to read more about using Renko charts on tradingview.com