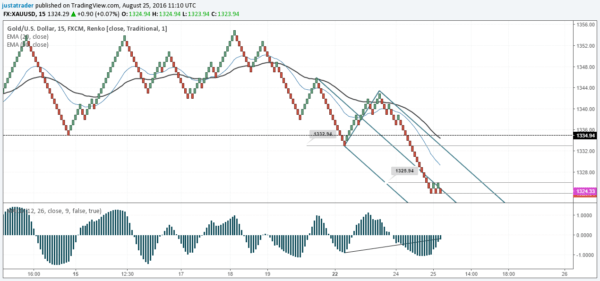

Renko charts, although independent of time can be used for scalping the intraday markets.

This strategy outlines the various concepts involved to build a reasonably short term trading strategy based on Renko charts and on the 15-minute time frame. In order to best make use of this trading strategy, we make use of the Renko charts from tradingview.com.

A pro account is needed in order to be able to see the Renko charts from a 15-minute time frame. You can read more about tradingview’s Renko charts here.

Tradingview’s Pro Account costs you $9.95 a month. It might seem expensive for some but when it comes to this trading approach, the monthly costs can be easily recovered by simply trading a lot size of 0.02 with at least 2 good set ups a week.

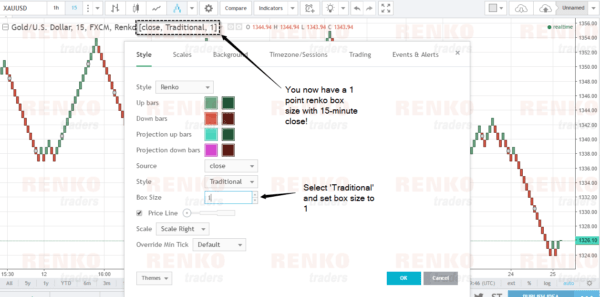

In this Renko scalping strategy the basic governing principle is that instead of using the daily close as a basis, we make use of the 15-minute close. This approach offers lots of possibilities for trading. It is also quick and you can move from one instrument to another to find a good and a reasonably priced risk/reward trading set up.

In terms of trading strategies, this approach is very open. Therefore if you like for example a moving average crossover you could use that.

Even price action traders can make use of their own trading strategies to trade this short term renko scalping method. If you are short of ideas, take a look at the different Renko trading strategies outlined here.

How to scalp with Renko charts

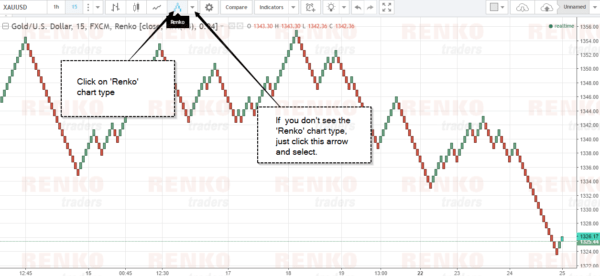

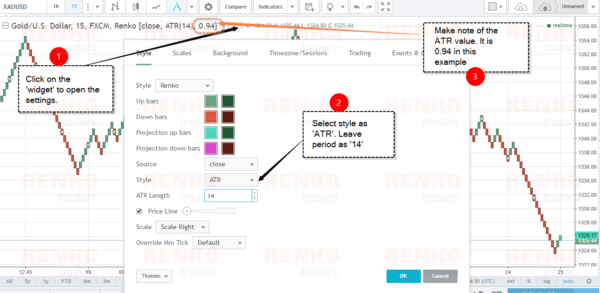

The first step is to select a currency pair of your choice. Let’s take an example of XAUUSD (Gold). You then switch to the 15 minute chart on tradingview.com.

Renko scalping on 15-minute close

The above mentioned strategy is one of the simplest and easiest to trade and master. It can be used on any instrument, although I recommend sticking to the majors and liquid instruments. While the framework is outlined, when it comes to using a trading strategy, it is entirely open and flexible.

So as mentioned earlier in this article, you can pretty much use any trading strategy of your choice here and make some very good pips on the intraday session.