Central banks have shifted, quite dramatically, from a zero-interest rate policy to a rate hike cycle. Thanks to external influences such as the Covid-19 pandemic, geo-political crises and inflation. The market’s have never been volatile.

For the most part, many traders of this day have never experienced living in an environment of rising interest rates. Traders can also see the market volatility in the forex markets as well. For some, this may be a time to make good money, for others it has become difficult to save money, especially with inflation eroding their purchasing power.

Times like these, it helps to gain some context. This is where, the book A History of Interest Rates (Fourth Edition) makes for a wonder read.

Book Summary – A History of Interest Rates

A History of Interest Rates, Fourth Edition by Sidney Homer and Richard Sylla is a comprehensive guide to the history of interest rates and their impact on economies, societies, and financial markets.

A History of Interest Rates, Fourth Edition by Sidney Homer and Richard Sylla is a comprehensive guide to the history of interest rates and their impact on economies, societies, and financial markets.

The book walks the reader through the different chapters, covering the evolution of interest rates since the ancient times.

In the opening chapter, the authors discuss the concept of interest rates and their role in the economy. They explain that interest rates are the price of money and that changes in interest rates have a significant impact on the economy and financial markets. The authors then provide a brief overview of the history of interest rates, from ancient times to the Renaissance.

The next several chapters delve deeper into the history of interest rates, exploring the factors that have influenced their evolution over time. For example, the authors discuss the role of religion, wars, and political events in shaping interest rates in the medieval period. They also explore the impact of the Industrial Revolution and the advent of capitalism on the development of interest rates.

Throughout the book, the authors use a variety of primary sources, such as government reports, historical documents, and academic journals, to support their analysis of the history of interest rates. They also provide detailed charts and tables to illustrate key trends and patterns in the evolution of interest rates.

Interest Rates and Economic Growth

One of the key themes of the book is the relationship between interest rates and economic growth. The authors argue that low interest rates have a positive impact on economic growth, as they make it easier for individuals and businesses to borrow money and invest in new projects.

On the other hand, high interest rates can have a negative impact on economic growth, as they discourage borrowing and investment.

Roles of Central Banks and Government Policies in Interest Rate Policies

The book also discusses the role of central banks and government policies in shaping interest rates. The authors explain that central banks, such as the Federal Reserve in the United States, play a critical role in setting interest rates, and that government policies, such as monetary policy, can have a significant impact on the economy.

The authors also explore the relationship between interest rates and inflation, explaining that changes in interest rates can have a significant impact on the rate of inflation.

In the final chapters of the book, the authors provide a comprehensive overview of the history of interest rates in the United States and other developed countries, including Japan and Europe.

They also discuss the impact of globalization on the evolution of interest rates, and the role of new technologies, such as the internet, in shaping the financial markets.

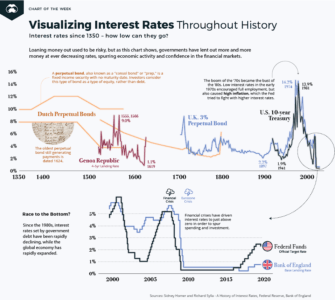

History of Interest Rates – Visual Infographic

Key Takeaways – A History of Interest Rates

The main concepts of the book, A history of interest rates include:

Interest rates in history: Provides an in-depth look at the history of interest rates. It traces their evolution from ancient times to the present day.

Interest rates in different civilizations: Gives a detailed examination into the development of interest rates in various civilizations. These include ancient Greece, Rome, and Babylon. It talks about how they influenced the development of modern financial systems.

The role of interest rates in the economy: Explore the role of interest rates in the economy, and how they affect investment, savings, and inflation.

The relationship between interest rates and monetary policy: Examine the relationship between interest rates and monetary policy. Understand how central banks use interest rates to control the money supply and stabilize the economy.

The impact of war on interest rates: The book discusses how wars and military conflicts have impacted interest rates throughout history.

The development of financial markets: Read about the evolution of financial markets. It covers developments of bonds, stocks, and other securities, and how they have influenced interest rates over time.

The evolution of banking systems: The book examines the development of banking systems, including the evolution of deposit banking and the role of banks in setting interest rates.

The impact of technology on interest rates: The book explores the impact of technological advancements, including the development of computers and the internet, on interest rates and the financial markets.

The influence of government and regulation: Learn about the role of central banks and regulatory bodies in setting and controlling interest rates. You will get an understanding how government and regulation go hand-in-hand.

The future of interest rates: Get insights into the future of interest rates and the role they will play in the economy. Read about factors impacting interest rate policies; demographic changes, technological advancements, and globalization.

From a reader’s perspective

The book can come across as dry at times. But it is definitely informative. However, if you are comfortable with numbers then you will definitely enjoy reading this.

While some might argue that this book is more for bond investors, the truth is that interest rates impacts everyone, from a bond trader to a stock trader and your corner store shop as well.

The book covers more than four centuries worth of history chronologically, to the current day. It also focuses on the Dutch and English financial systems which form the backbone of today’s financial environment.

About the Authors – Sidney Homer and Richard Sylla

Sidney Homer

Sidney Homer was an American economist and financial historian. He is best known for his work on the history of interest rates. Born in New York City in 1904, Homer studied economics at Columbia University and later earned a Ph.D. in economics from the University of Cambridge. He went on to teach economics at Columbia University and was a researcher at the National Bureau of Economic Research.

Homer is most famous for his book “A History of Interest Rates.” It is considered to be one of the most important works on the history of interest rates.

In addition to his work on interest rates, Homer was also known for his expertise on the bond market. He wrote several books on the bond market and was a sought-after speaker on the subject. He was a frequent contributor to financial publications and was a respected voice in the financial community.

Throughout his career, Homer was recognized for his contributions to the field of economics and finance. He was awarded numerous honours and awards, including the Distinguished Contribution Award from the National Bureau of Economic Research.

Sidney Homer passed away in 2000. But his legacy lives on through his influential work on the history of interest rates and the bond market. His contributions to the field have been widely recognized and his work continues to be studied by economists, financiers, and financial historians.

Richard Sylla

An economist and a financial historian, Sidney Homer is best known for his various works about interest rates.. Born in 1946, Sylla received his B.A. in economics from Columbia University and later earned his Ph.D. in economics from the University of Pennsylvania.

Richard has had a long and distinguished career in academia and has held teaching positions at several universities, including New York University, where he is currently a Professor of Economics and Financial History. Throughout his career, he has been a prolific writer and researcher and has published numerous articles and books on the history of finance and economics.

In addition to his academic work, Sylla has also been active in the financial industry. He has served as a consultant for numerous financial institutions. Sylla is also a frequent speaker at financial conferences and events.

Richard Eugene Sylla is an expert on the history of finance. He is also one of the leading authorities in the field. He has received numerous honours and awards for his contributions to the field of financial history, including the Alexander Gerschenkron Prize from the Economic History Association.

Sylla is a highly regarded financial historian and economist who has made significant contributions to the fields of finance and economics. His work has been widely recognized and continues to influence scholars and financial professionals alike

Book Review Conclusion

A History of Interest Rates, Fourth Edition, is a comprehensive and well-researched guide to the history of interest rates. If you have a genuine interest about interest rates and monetary policy, then the History of Interest Rates is a must-read. The book will without a doubt enhance your knowledge about the importance of interest rates. From a trading perspective, you can use this knowledge to better fine-tine your trading strategies as well.

The authors provide a clear and accessible analysis of the factors shaping the evolution of interest rates over time. It covers the impact on the economy and society. The book is an essential resource for students, academics, and professionals in the field of finance and economics.