A new type of modified Renko bars, known as the Median or Mean Renko bars have been doing the rounds. While the Median (Mean) Renko bars might come across as a fancy new way to trade with Renko charts, truth is that there is not much of a difference when compared to the regular Renko bars. In this article, we’ll introduce some of the differences between the median or mean Renko and the traditional standard Renko charts so the reader will be able to make an informed choice and draw their own conclusions. The focus of this article is to simply identify the differences between the two.

Median (Mean) Renko bars vs. Traditional (or Regular) Renko bars

The Principle/Concept: Mean Renko bars work on the same principle of the traditional Renko bars, meaning that they (Median/Mean Renko bars) are also focused purely on price movements and not on time. The main difference between the median Renko bars and traditional Renko bars is based on the fact that the midpoint of price is used as a reversal rather than price moving ‘x’ pips from the previous closing Renko brick. An interesting point to observe here is that the opening price of the mean renko bar is a synthetic open (regardless of whether price falls to the mid point of the previous mean renko bar or not, the open is always plotted here)

(Learn: Types of Renko Charts)

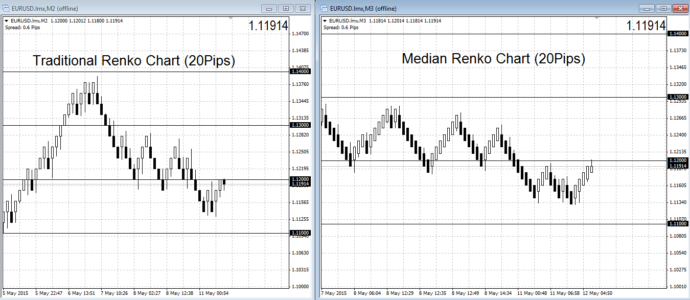

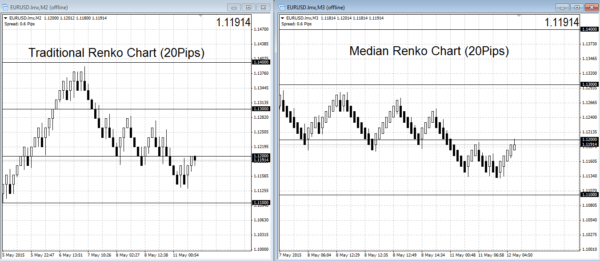

Chart Comparison: The chart below gives an indication of how the Median Renko Bars look in comparison to the Regular Renko bars. In this comparison chart, we make use of the standard 20 Pip fixed size Renko. The chart on the left, shows the traditional Renko Chart, while the chart on the right is based on the Mean Renko with a 50% retracement, meaning that a new Median Renko brick is printed when price reverses from the 50% price point of the previous brick and closes 20 pips below or above.

(Learn: Renko ATR vs. Fixed Size)

Median Renko Price – How it works: With a Median Renko brick, the price point in focus is the midpoint of the previous Renko brick. For example, if Brick 1 opened at 1.1261 and closed at 1.1281 (a 20 pip brick), then a new Median Renko Brick is printed at the midpoint of the previous mean renko bar, which is 1.1271 and closes 20 pips lower (to 1.1251). The price point of 1.1271 forms the median price (Open + Close/2) of the previous Renko brick.

The main difference as we can understand with this explanation is that a traditional Renko brick is usually printed when price either rises above the previous higher close but with the mean renko bar, the open is synthetic. But is this synthetic open always the case? No. Sometimes price does pull back to, or below or close to the mid point of the previous mean renko bar.

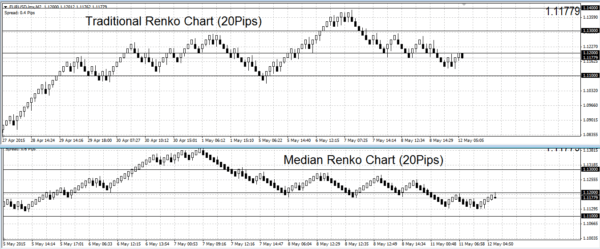

Median Renko Charts – Smoother Indicator of price: The Median Renko charts visually depict a smoother price movement. The next chart below shows how price action is visibly smoother with the median Renko bars as compared to the traditional Renko bars. The Median Renko charts tend to have little pullbacks with opposite colored bricks and tend to show price trends in a more easily recognizable fashion. In a way, the Median Renko charts look quite similar to the Heiken Ashi candlesticks, which most traders are aware of.

Is Median (Mean) Renko Chart a better indicator than standard Renko Charts?

The next question that is probably on the reader’s mind is if the median Renko chart is a better indicator than the traditional Renko chart.

As you might have seen by now, there are some distinctive advantages of the median Renko chart over the traditional Renko chart. Hands down, trends are more visible and easy to determine with the median Renko chart. It therefore makes for a good indicator when it comes to markets that are moving in an established trend. Trend reversals are also easier to identify and in the very short term, the median Renko chart can add value.

Where to download the Median Renko Chart?

The Median Renko Chart is available for download from az-invest.eu. The plugin (indicator) is compatible with the latest version of MT4 and support ensures that the plugin is updated to any future updates or builds from MT4. The Median Renko chart is available for $35 or $50 (Standard or Pro versions). However, the Standard Version of the Median Renko chart should suffice if you do not want back testing and strategyquant support.