You can trade futures with Renko charts to get a unique perspective of the futures markets. There are many trading strategies when it comes to the futures markets. But we won’t cover that in this article. Some might also argue that the regular candlestick charts or bar charts are more than enough for that matter. While that may be true, there are still quite a few day traders who are interested to know how they can trade futures using renko charts.

This article is for them as we focus on how you can make use of Renko charts to better navigate the futures markets.

The futures markets are exciting!

Trading futures can be a great way to make profits on a wide number of markets. There are many things that draws a trader to the futures markets, some of them are leverage, regulated markets, centralized exchange and standardized contracts to name a few.

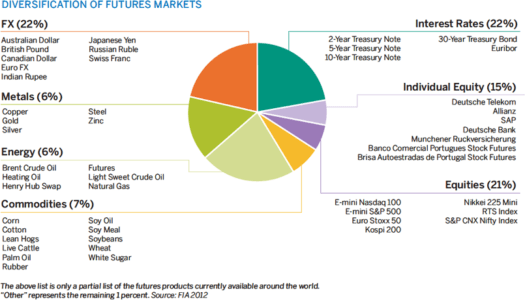

And lets not forget the variety of different assets that one gets to trade. From precious metals to commodities, grains to juice (softs) to even weather (if permissible), the choice is endless.

Futures trading is a derivatives market based trading, meaning that the price of the futures markets are derived from the underlying asset that is being tracked.

For example, if you were trading Gold futures, the pricing you see is derived from the spot gold prices that are marked to market on a daily basis. The derivatives nature of futures makes it easy for speculators as well as investors to hedge their exposure from the underlying markets.

Let’s say you are invested in the SPDR Gold ETF (GLD) and you are concerned that gold prices will drop. But you are not sure on how steep the correction will be. What would be the best thing to do without affecting your portfolio? You can simply go short on gold futures contracts and make a profit if you were right.

This article won’t go into the details of futures contracts, what they are and how they differ from other markets, on the contrary, the article assumes that the reader already knows about the futures markets and would like to apply Renko charts analysis to their futures trading.

How to trade futures with Renko charts?

The futures markets unlike forex or stocks, is a mixed market.

It goes without saying that when one mentions forex, the first thing that comes to mind is currencies.

When you talk about stocks, the first thing that comes to mind is of course stocks. Each of these homogenous markets have something in common and you would know on a broad level how the markets react and the factors that influence these markets.

Furthermore, you can expect to see a $2 – $5 move in stocks and sometimes more, which won’t be that surprising to a stocks trader. Likewise, you can expect to see a 100 – 500 pip move in forex, which again doesn’t come as a surprise.

With the futures markets, there is a broad mix of underlying assets being tracked, making the futures a heterogeneous markets.

You can trade metals, interest rates, currencies, live cattle, agriculture and many more assets as we mentioned above. And each of these markets in turn come with their own set of rules such as tick size, contract size and so on.

You can understand by now that the different make up of the markets means that trading can be a bit tricky. You can’t apply one trading strategy built for a particular futures market asset class to another.

Think about it!

Going back to the same example, can you expect a strategy that is built to trade forex (and thus by extension, currency futures) be able to give you the same results when trading equity index futures?

Obviously not! Still, many traders end up making the mistake and apply a trading strategy without thinking on whether the strategy makes any logical sense or not.

Trading Futures with Renko – Start with the renko box size

The Renko box size is the most important aspect that can determine your success or failure with futures trading.

Having the right box size is important as it can help you to understand your risks while also enable you to build a profitable trading strategy. Set your renko bricks too big and you might be in for a margin call. Set your renko brick too small and you might get hit by the volatility.

The solution therefore to have the right renko chart is to understand the futures market you are dealing with and looking at it independently.

The first step in determining the right renko box size to use in futures trading is to understand the minimum tick and the tick value.

What is the minimum tick and tick size in futures?

The minimum tick in the futures market is the minimum fluctuation in price.

Because the futures markets are a diversified set of assets, the minimum tick size can vary. For the E-mini S&P500 futures for example, the minimum tick size is 0.25 points with each point representing $12.50 in dollar value.

For the Dow Jones E-mini futures, the minimum tick size is 1 index point valued at $5.

As you can see, using the same yard stick for S&P500 and the Dow futures doesn’t make any logical sense. Furthermore it certainly doesn’t make any sense when you apply the same yard stick to different markets as varied as equity index and commodities for example.

You can read this example about Emini S&P500 Futures Renko chart and how the box size was selected based on the tick size and the tick value.

Risk management plays a role in Futures trading with renko chart

Once you have determined the tick size and the tick value, the next step is to look at your trading capital and apply some risk management principles.

Let’s run this with an example.

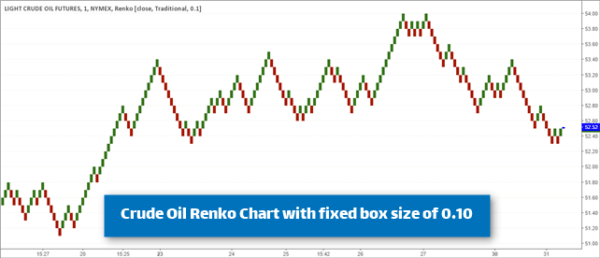

Lets say that you want to trade Crude oil futures (CL).

The minimum tick size for crude oil is $10 for a $0.01 tick size.

Therefore, it now comes down to how much of risk you can bear. For example, if your trading capital is $5000, and you can risk 2%, that roughly translates to $100 in risk.

Converting this $100 to ticks you can divide the risk by the minimum tick, which is $100/$10 = $10, which is 10 ticks or $0.10 (10 x $0.01).

Thus, from the above, we have a Crude Oil futures Renko chart with a fixed box size of 0.10, as shown below.

Can you use this same method for other futures renko charts too?

Yes and this is just one of the most basic ways to build a Renko chart for futures trading.

You can also looking increasing or decreasing the Renko box size in multiple of 5 or whatever number you fancy until you find that the Renko chart captures trends on the futures markets you are focusing on.

Once you have the right box size, you can then proceed towards looking at applying one of the many different Renko trading strategies that are outlined here. The most important thing to note is that there is no magic number for CL futures for example.

The best way to go about building renko charts for futures is by experimenting and knowing which brick size will work best for you. As we mentioned earlier, there is a lot of subjectivity. Therefore trader A can find it comfortable to trade with a brick size of 3, while trader B will find it comfortable to trade with brick size of 5.

The price movement of the underlying futures instrument that you are trading also plays an important role and this is something that traders should keep in mind. Let’s also not forget that the historical time series of the futures instrument plays a role.

After all, renko charts are not time based charts. Therefore you need to have good historical data for the renko bricks to populate.

Pay attention to the volatility

When renko trading in the futures market is to ensure that you also pay attention to the volatility. Since different futures instruments can exhibit price action differently, volatility can play a big role.

We already know that in many cases, a futures instrument can exhibit good trends. But volatility can rise or fall for a number of reasons. For example, when a futures instrument nears expiry, it becomes less liquid. This can in turn lead to muted price action.

Likewise, the price movement can be sharp and pronounced, leading to higher momentum when there is a big news release. Trading such moves using renko bricks will require a good trading system that you are comfortable with.

What trading platforms allow to use Renko charts on Futures markets?

As mentioned earlier, the futures market is quite different from the rest. And it also takes a specialized broker to offer futures trading. Many futures brokers are domiciled in the U.S. as they need to be licensed and regulated. As a result, traders outside the U.S. will find it difficult to sign up to such brokers. But for futures day traders, this should not be an issue.

You might find a few futures brokers based in Europe too.

Most of the futures brokers tend to have their own bespoke trading and charting platforms. But in some cases, you might find some futures brokers offering the MT4 or the MT5 trading platforms. These platforms as you know have a vast eco-system.

This means that you can easily use one of the many renko trading indicators in order to plot the renko charts for you automatically. But if nothing else works, we recommend that you use the Renko charts from Tradingview.com.

This will at the very least allow you chart the markets with relative ease.