A simple forex trading strategy is something that we as traders love to get our hands on. However, the term simple forex strategy can be very subjective and depends on the person you ask.

For one trader, a simple trading strategy might be one that has just a few indicators. For another trader, a simple or an easy forex trading method might just be price action based.

No matter what kind of answers one might get, I am sure that all traders will agree that a simple or an easy forex trading strategy is one that does not clutter the charts too much and is easy to understand and more importantly, the amount of variables involved (you may also call them as rules) are minimal.

Thus, a forex trading strategy such as buy when A happens and B does something can be considered as a simple enough strategy which anyone can apply. Going beyond the basics, a simple forex trading strategy is also one that has a fairly reasonable risk/reward set up. There is without a doubt that a trading strategy must have a 1:2 risk/reward setup and anything beyond this can be considered to be very good.

There are many Renko based forex trading strategies listed on this website. However I am always on the lookout for a trading system that is not only easy to understand but good enough to trade. These are some of the factors that could qualify it to be a simple forex trading strategy.

So without much further ado, here’s introducing a rather simple trading strategy.

The Swing Failure Method

The idea for this easy forex trading strategy came from the concept of swing failure. This was a method that was outlined in the Dow Theory. This is not to be confused with the RSI Swing Failure method that is mentioned here. There is however some similarly in the concept.

The Swing Failure method is a rather old yet very robust concept in the markets. It was first introduced in the work published by Charles Dow and his partners and are part of the Dow Theory principles. The Dow Theory’s swing failure builds upon the concept that in the financial markets, the trend remains in effect until it is acted upon by an external source and the reversal is clear.

If the above seems too complex for you, it actually isn’t as there are different variations of this already used in the markets. Examples include the Alan Andrews’ median lines or pitchfork trading method and the action-reaction line method.

How to identify the trend?

According to Charles Dow, an uptrend is where price rises steadily and makes higher highs (peaks) and higher lows (troughs or dips). Similarly, in a downtrend, price declines steadily and makes lower highs and lower lows.

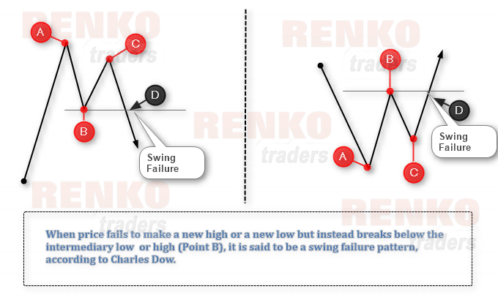

When price fails to make a new low or a new high and reverses course, and starts to make a new high or new low, it is considered to be a swing failure and indicates a change in trend.

These swing failure methods are usually used in the markets as support/resistance levels. The above chart shows the Dow’s Swing Failure method. As you can see, there is nothing complicated about this.

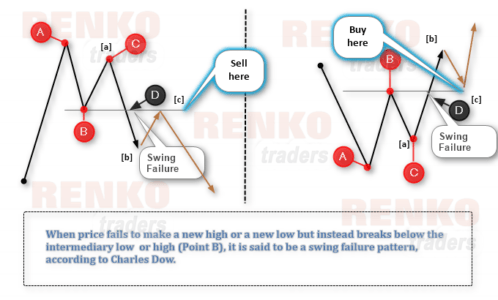

Now that we have an understanding of the swing failure chart, we can already form an idea on where to go long and where to go short using this rather simple concept of trading.

Trading rules for a simple renko trading strategy using Swing Failure Method

As the chart above shows, we look for short or long positions at D. Ideally we can expect to see some retracement back to the low or high formed at point B, which is where this strategy takes a little bit of a twist. Once we expect a retracement to D, we then look for the ABC pattern.

Look at the above chart but with some minor modification now, to get an idea. Again, it looks a lot easier and simple visually.

For the stop loss, we look at a local low (and don’t mistake this with placing your stops at ‘C’), within the C leg. For the targets, the first target is of course the point [a] followed by an equal measure or two times from entry to first target.

Simple forex renko trading strategy – Trade Examples

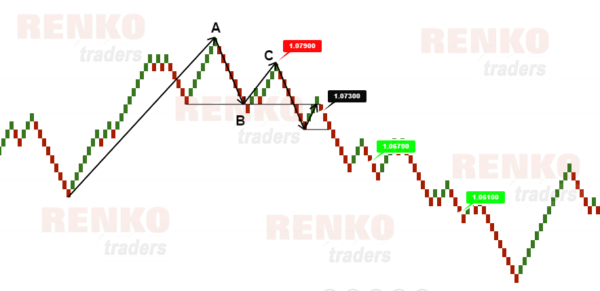

In the first example below we have a swing failure pattern that was set up with a lower high formed in C. However, we had to wait for a confirmation meaning that price had to break down below B and then retest this level to establish resistance. Once we had a Renko reversal box here, a short position was initiated, with the stops at C (because there was no local high here).

The first target was at the first reversal level at 1.0710. This was then followed by 1:1 target at 1.067 and 1:2 target at 1.0610. After the first target was reached, the trade would be moved to break even. Therefore, the trade gave a small profit of 20 pips and no risk left.

Thus, the eventual decline to 1.067 and then to 1.0610 gave additional profits of 60 and 120 pips. Remember that these profits came at no risk. In total, this trade returned a total of 200 pips in profits, with the initial risk of 60 pips, which is more than 1:3 risk/reward set up.

Simple forex renko trading set up – Long example

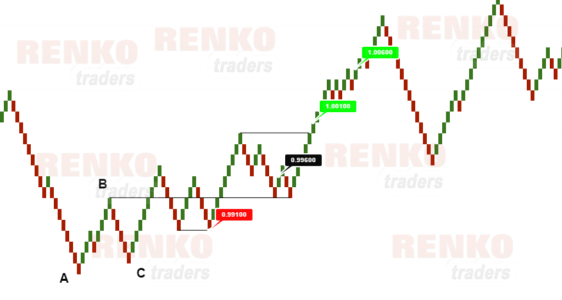

The next example shows a long set up method, which is slightly mixed. Here you can see that there was a swing failure at C. After price broke out above point B, there was no reversal at B, but instead, price fell lower (0.9910). This does not change our bias unless price fell below 0.9910.

Then, we can see price lifting off, only to fall back to B with a reversal Renko bar at 0.9960. So we go long here with stops at 0.9910. The first target is of course 0.9990 which is the previous peak. The next target comes in at 1.0010, followed by 1.0060.

The initial risk was 50 pips which was moved to break even upon reaching the first target. This gave a profit of 40 pips. The remainder of the profits of 50 and 100 pips came at virtually no risk left on the table. There was also the additional benefit of already having made 40 pips.

While the initial risk was 50 pips, the trade profited 190 pips. This is 1:3 in terms of risk/reward.

Simple forex renko trading strategy with Swing Failure

From the above two examples, the set up is very simple and doesn’t quite require any indicators. The key to success with this strategy is of course in being patient. Patient enough as you can see in the second example. Being impatient would have resulted in a lost trade or a bad entry.

What works in the favor of this simple forex trading strategy is the risk reward set up. The minimum risk reward set up is always 1:2. The fact that the stops are quickly moved to break even makes it even more robust. If you are looking for other easy ways to trade renko, read more about this simple renko scalping system.