The U.S. dollar closed weaker last week and this could be indicative of the much needed correction in the dollar index. For USD currencies, this would translate to a short term bounce in the markets. Although the near term trend looks to be to the upside, it offers an opportunity to look to the short side in the longer term. In the near term horizon, the markets will be looking to the ECB and Fed decisions which will be a key market moving event.

Last week, data showed a continued strength in the U.S. economy. ISM manufacturing index released on Thursday came out better than expected at 53.2, better than the forecast number of 52.0. The ADP payrolls report was also solid, with private sector hiring showing 216k jobs, more than the 161k forecast.

Friday’s payrolls report was a mixed bag as the payrolls increase was near estimates and the unemployment rate falling to a 9-year low at 4.6%. But the average hourly earnings fell 0.1%, missing estimates of 0.2% increase. However, on a yearly basis, average hourly earnings are seen to be stronger which indicates that the economy and the labor markets will remain strong. All of this supports the view that the Fed is very certain to hike interest rates later in December.

Technical Outlook

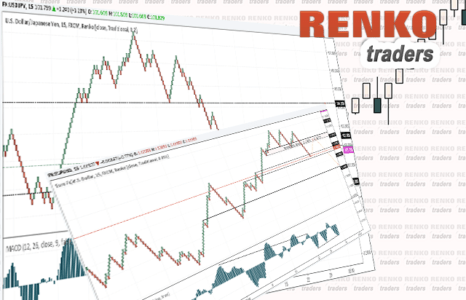

EURUSD bounced off the reversal zone of 1.0577 – 1.0587 as mentioned in last week’s technical outlook. In the near term, EURUSD could be seen pushing lower between 1.0659 – 1.0629. A reversal from here could see price continuing to the upside, potentially testing the 1.0737 resistance level. The bullish bias will be invalidated on a possible break down of prices below 1.0629, in which case we can expect a retest back to the 1.0577 – 1.0587 support level. Beyond this support, EURUSD could slip back towards the 1.0500 support level that is likely to be challenged.

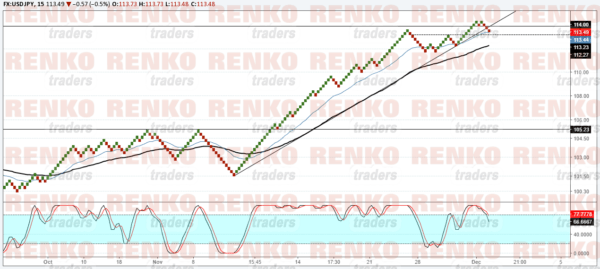

USDJPY finally managed to test the resistance level near 114.00 and promptly reversed lower from here. We can now expect the declines to resume, provided USDJPY can break the 113.23 – 114.00 resistance level. The correction towards 105.23 remains in focus below this resistance level which should offer some good rewarding trading opportunities. Alternately, a move back above 114.00 could signal a continuation to the upside.

EURCAD was bearish last week and the descending triangle pattern formed was validated by the break down below 1.4214. This will see a continuation towards 1.4064 in the near term, which could then offer a short term bounce. Alternately, depending on how the euro reacts to tomorrow’s Italian referendum, a reversal off 1.4168 could signal a move to the upside towards the original target of 1.4614. This move is also validated by the bullish divergence on the Stochastics.

Gold prices are potentially forming a breakout at 1176.36 resistance. A break above this level will see gold prices rise to as much as 1215 level in the near term. The Stochastics are however moving to the oversold level. Therefore, look for a breakout initially followed by a retest back to 1176.36 where support can be established. This will make for good long positions targeting 1190 and 1200 respectively.

Fundamental Outlook

Tomorrow’s Italian referendum will be weighing on the markets, but the reaction could be different from what is expected. Gold prices could be seen rising on a ‘No’ vote and the euro is also tipped to jump on the news.

Later in the week, the ECB’s meeting will be the main event to focus on. The markets will be looking for an announcement from the ECB to expand the date of its QE purchases from March 2017 to September 2017. This will be bearish for the euro, but the reaction could be muted as the event is already priced in. It will all depend on where the euro will be trading heading into the ECB’s meeting. Anything beyond this will be a surprise, including an unexpected expansion of QE, but this possibility remains unlikely for now.

In other news, the RBA and the BoC’s meetings this week will likely pass off uneventfully. Both the central banks are expected to keep the respective interest rates unchanged, pushing the ball to the FOMC meeting in two weeks time.

On the economic front, Japan’s revised GDP numbers will be coming out with expectations of a modest revision to the upside, but it is unlikely that this will have any big impact on the yen crosses.