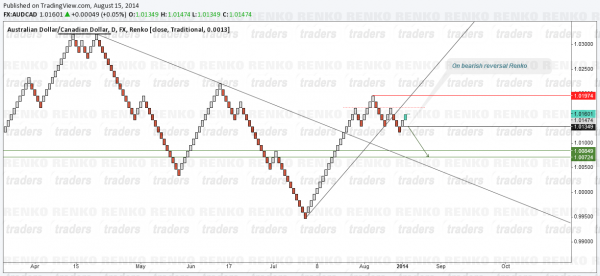

There seems to be a minor head and shoulders pattern formed in AUDCAD Renko chart with the neckline at 1.0135. After a break of this neckline price reversed back to close above the neckline. While this could potentially invalidate the minor head and shoulders pattern, if we see a bearish reversal renko from 1.016 closing at 1.0135, we could possible take a short position targeting 1.0085 – 1.00725

The basis for trade comes from a possible retest of the downtrend line that was broken recently.

Besides the head and shoulders, we also see how the Renko boxes broke above an intermediary downtrend line. A retest of this break is the most likely path AUDCAD could take. This retest see’s support at 1.0085 region which gives us the bias to short this pair provided we can see a bearish reversal being formed.

The stops for the short position would come in at 1.01725.

In terms of risk/reward this trade doesn’t rank high, but the probability of the retest back to the trendline that was broken gives us an impetus that this downside move is very likely to happen.

Therefore: Short AUDCAD from 1.0135, targeting 1.00725 with stops at 1.01725.

The validation for the shorts will come when there is a bearish reversal closing below 1.0135