One of the most commonly asked questions is the difference between Range bars and Renko bars.

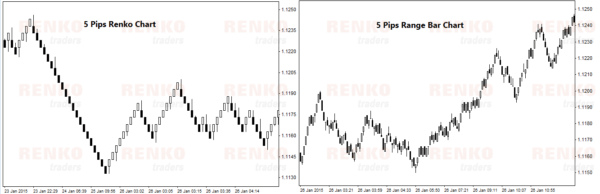

At a first glance, it is easy to find some similarity between a Renko bar and a Range bar. In fact, there is something common between these two chart types. They are both independent of time and focus on price alone.

However, that’s where the difference ends. In this article you will learn about what are Range bars and more importantly how are range bars different from renko bars.

Range Bars – What are they?

Range bars were the brainchild of a Brazilian trader, Vincente Nicolellis. He designed these custom chart types in 1995. The reason for coming up with this rather unique chart type was because he tried to come up with a solution to trade the local markets in Brazil, which tend to be very volatile.

To handle the volatility he came up with range bars so as to eliminate time off the equation completely.

In a range bar, all price bars are of equal length. So for example, if you set a 10 pip range bar, then all bars are of 10 pips range (high to low, or low to high). This is also quite similar to Renko bars, where every Renko bar is of equal length.

However, with Range bars, the way new bars are plotted is completely different. They follow a specific set of rules.

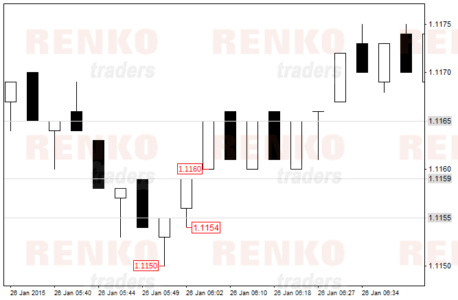

If you had a 10 pip range bar, and EURUSD was trading at 1.1000, then the range bar would close only when EURUSD crossed above 1.1010.

Then, a new bar opens at 1.1010. Now, if EURUSD fell to 1.1005 and then closed at 1.1015, a second range bar is formed with the third range bar opening at 1.1015. Now, EURUSD rises to 1.1020 and then falls to 1.1010. A third range bar opens at 1.1020 and closes at 1.1010. Finally, EURUSD rises to 1.1015 and then falls to 1.1005. A fourth range bar opens at 1.1015 closing at 1.1005.

So, between the price levels you have four range bars.

You might ask why two range bars when the price distance between 1.1000 and 1.1015 is only 15 pips. That is because, when EURUSD fell to 1.1005, that forms a low, and therefore, 10 pips is calculated from that low.

In range bars, the close of a bar is always equal to the open of the next bar. The range is measured as a high and low and not close.

Now let’s apply the same price levels to a Renko chart and see where the difference is. For similarity, we will use a 10 pip Renko box.

EURUSD is at 1.1000 and moves to 1.1010. This marks the first bullish Renko box.

A new Renko box is opened at 1.1010. Now EURUSD falls to 1.1005 and then rises to close at 1.1015. This marks a second bullish Renko box. EURUSD then rises to 1.1020 and falls to 1.1010, we are still at the second Renko box (because for a reversal, we need 2 times the box size, which is 20 pips in this example).

EURUSD then rises to 1.1015 and then falls to 1.1005; this is when we get a bearish Renko reversal box.

The above example might a bit confusing, but if you read it again you will see that while we had four range bars between 1.1000, then a rally to 1.1020 and then a decline to 1.1005, with Renko we had just two bullish bars and one bearish reversal bar.

Difference between Range Bars and Renko Bars

| Range Bars | Renko Bars |

| Range Bars are independent of time | Renko Bars are independent of time |

| In range bars, every bar is of the same length (including reversals) | In Renko bars, every bar is of the same length (including reversals, but price must travel two times the Renko bar in the opposite direction) |

| Range bars can help to identify ranging price action very nicely | Renko bars help identify ranging price action, but you can expect flat or opposite bars printed if the ranging price action continues |

| Range bars can be applied to any market | Renko bars can be applied to any market |

| Range bar typically has an open, high, low close | Renko bars has an open and close (if wicks are enabled you can see the high and low) |

| In Range bars, high and low are the most important price levels | In Renko bars, closing prices are the most important |

Range bars or Renko bars? Which is better?

The next obvious question that comes to mind is whether Renko bars or range bars are better.

The fact is, there is no telling and just as there is no best trading indicator, it is the same for Renko or range bars as well. It comes down to a trader’s familiarity with the price chart that they are using.