Last week saw the FOMC, BoJ and the RBNZ meetings. There were no changes to the FOMC and the RBNZ interest rates. The BoJ sort of disappointed the markets by failing to expand stimulus or cutting interest rates lower, resulting in a strong yen. On the economic front, the markets were fairly quiet with flash estimates making up for the remainder of the week.

With the final trading week for September coming up, the markets could continue to move within short ranges while the overall longer term trend across most of the currencies remains flat.

Technical Outlook

XAUUSD: Gold prices were supported by the dovish central bank decisions last week. However, the gains were muted. The 1 point fixed renko box size for gold shows a head and shoulders pattern forming, which indicates a decline to the downside. The bearish view is further validated by the bearish divergence to the MACD. While the outlook is bearish for gold, traders can expect to see some choppiness. For starts, the MACD histogram is already bearish, so unless there is renewed momentum, we can expect a fake out here with gold moving back higher. Look for $1340 as the ideal level to position to the short side, targeting 1325 and finally 1317. The short bias remains invalidated only on a close above 1342.

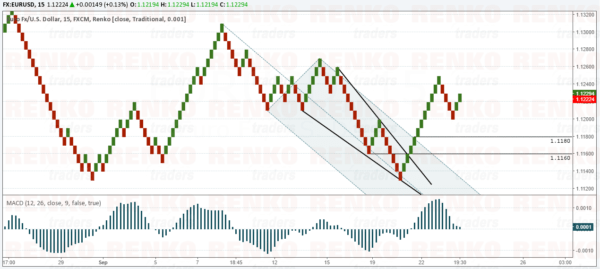

EURUSD: EURUSD rallied above 1.1240 last week but pulled back strongly thereafter. While there was a modest reversal near 1.1200, the current upside looks to be fading. The 10 pip renko chart for EURUSD shows that there is a possibility for EURUSD to decline to 1.1180 with the potential to slide to as much as 1.1160. The reasoning here being the breakout from the falling median line which did not see any pullback prior to the rally. Also, the retest from the falling wedge pattern was absent, both of which indicate to a near term decline in EURUSD.

GBPUSD: Price action has been bearish for the past few weeks and GBPUSD extended losses into Friday’s close. Price action is now near 1.2950 region which is formed near 1.2950 – 1.2890. We can expect GBPUSD to consolidate at this level before pulling higher. Look for a pullback to 1.2950 – 1.3000 level as the bullish divergence could see GBPUSD rally towards 1.3150 and potentially to 1.3250. Timing is essential here as price action in GBPUSD must show a reversal near the price channel.

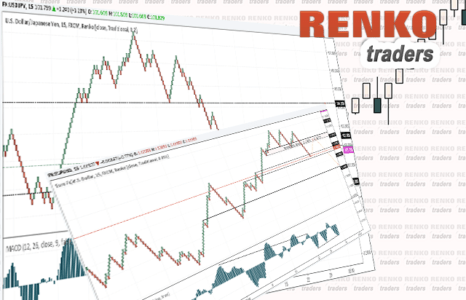

USDJPY: USDJPY fell to 100.29 and reversed following the breakdown from the head and shoulders pattern. Neckline support is seen at 101.69. In the near term, we can expect USDJPY to retrace some of these declines and could therefore retest the neckline support which could now turn to resistance. Look for price to breakout from the mid-line of the price channel and a pullback to form a reversal as a validation tool for long positions targeting 101.69. A breakout above 101.69 will see further gains coming, but seems unlikely for now.

Fundamental Outlook

Next week, many Fed officials are scheduled to speak including the Fed chair, Janet Yellen. After leaving interest rates steady last week despite coming out strongly hawkish, the Fed chair is likely to maintain the hawkish tone at least for the sake of her credibility. On the economic front, US final GDP data for the second quarter is coming up alongside new home sales and durable goods orders data. From the eurozone, Mario Draghi will be speaking this week and economic data will see flash CPI estimates for September coming out on Friday. Expectations are bullish with forecast point to an increase in both headline and core CPI.

Many other central bank governors will be speaking this week too including Kuroda from the BoJ, Poloz from BoC and Thomas Jordan from the SNB.