The European Central Bank meeting was the main event last week which sent the euro plunging to a 7-month low. Although Mario Draghi did not reveal much, clearly stating that the QE tapering or extension was not discussed, the euro early on in anticipation that the ECB was more likely to expand its QE purchases beyond the current March 2017 deadline. The market behaviour suggests an early pricing in of a potential QE expansion, a decision that could be taken at the next ECB meeting in December. But at the same time, it also exposes the risk of a disappointment, as seen in December 2015.

In other news, the Bank of Canada was seen holding rates steady but sent a dovish reminder to the markets which saw the Canadian dollar falling on the central bank monetary policy release.

In economic news, data from the UK showed that the 20% plunge in the British pound since June was taking a toll on inflation with experts suggesting that inflation could rise to 3% by next year, overshooting the Bank of England’s inflation target of 2%. Job growth was showing signs of cooling with wages rising less than expected indicating that higher inflation and weak growth of wages could weigh on consumer spending in the coming months.

Technical Outlook

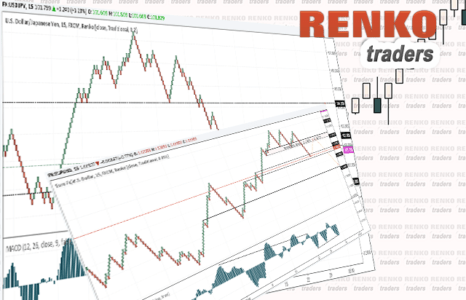

NZDUSD: The kiwi gave up its gains towards Friday after maintaining a strong rally for the most part of the week. Despite the quarterly inflation figures coming out better than expected, markets are expecting the RBNZ to deliver another rate cut, either in November or December. NZDUSD closed at 0.7163 on Friday and further declines can be expected after price broke down from the rising median line. In the near term, expect a retracement towards 0.7200 which marks a retest of the breakout level. A reversal here could signal downside bias towards 0.7120. Therefore, look for NZDUSD to sell the rally as price approaches 0.7120 support.

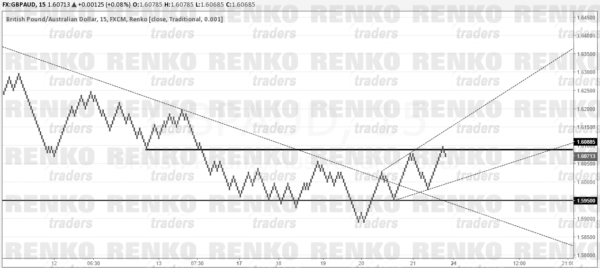

GBPAUD: The British pound has been regaining some of its lost ground against the Australian dollar. This was seen by the break of the falling trend line which eventually saw GBPUSD rally towards 1.6100. However, the reversal near this price level coincides with a retest of the previously broken support level. With resistance now established here, and GBPAUD moving in a broadening wedge pattern, we can expect near term declines in GBPAUD towards 1.5950. Look to sell GBPAUD near the current levels, targeting 1.5950. A close above 1.6100 could invalidate the short bias.

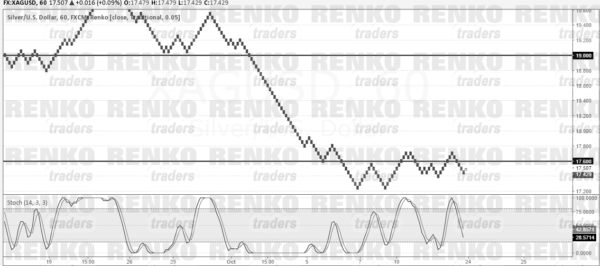

XAGUSD: From last week, Silver prices have managed to maintain the upside bias, staying afloat above 17.10. Resistance is clearly seen at 17.60 and a break of this level is essential to open up the upside in silver prices. The retracement could seen silver rise back towards 19.00 over the coming weeks. The Stochastics on the chart shows price likely to form a bullish divergence as well expect to see the Stochastics turn bullish from the current levels near 40.

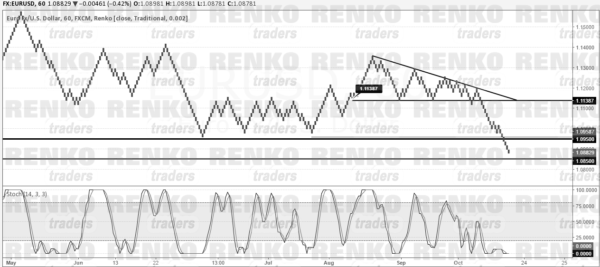

EURUSD: The downside in EURUSD continues with price breaking below 1.0900 last week. Further declines can be seen coming as 1.0850 remains the next key support level that could be tested. We can expect a reversal from this level in the near term. While the Stochastics are currently very oversold, expect a bit of choppy price action near 1.0850 level. Look for a possible higher low in the Stochastics to confirm the retracement back to 1.1100 over the coming weeks.

Fundamental Outlook

The week ahead will see data from the US which includes the durable goods orders for September. Later on Friday, the advance GDP report will be coming out with forecasts showing a 2.50% increase in the third quarter. This could be volatile as some independent GDP trackers show growth near 2.0% – 2.5%. So anything below 2.5% could be seen dollar negative. In the UK, the third quarter GDP is expected to show 0.3% economic growth, nearly half of the economic growth seen in the second quarter. BoE governor, Mark Carney is also expected to speak bringing additional volatility to the GBP. From Japan, the monthly inflation figures will be released and expectations are to the downside.