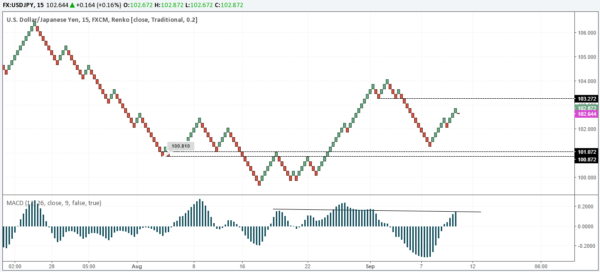

From last week’s technical report, we had EURUSD reaching the target, while silver short trade got stopped out. USDCHF trade did not trigger and USDJPY is halfway there. Continue to maintain the short position in USDJPY targeting 101.01 – 100.81 price level.

The week ahead will be the final week before the September 21st FOMC and BoJ meetings. Expect fireworks, if not volatility at the very least. With two important central bank decisions looming, the markets, stocks, currencies and bonds will be greatly affected.

Will the Fed hike rates in September? Will the Bank of Japan expand on its monetary policy and cut rates further? Answers to these questions might come this week as the markets start to price in the appropriate expectations. Expect sudden price action this week, which could move on rumors.

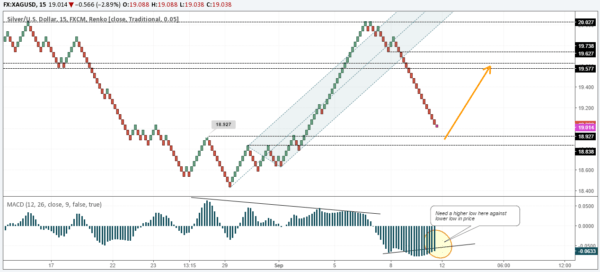

XAGUSD: Price action nudged higher towards the $20 handle before reversing. What’s missing in the decline is a pull back as price fell rapidly. We can expect a near term bounce in Silver as it approach the originally intended target of 18.927. Once price reaches this level, look to the oscillator for a potential bullish divergence, which should see price retrace the breakout from the median line. Click on the chart to see the potential price levels.

USDJPY: Despite the reversal which was near 101.272, we still expect to see USDJPY decline towards 100.87 – 101.07 region. It is essential that USDJPY finds support at this level as any gains without establishing support here could be at risk. Although the price action looks tricky, it is best to wait for USDJPY to establish support at 100.87 – 101.07 before taking any long positions. To the downside, a close below 99.86 could invalidate the long position and put USDJPY into a bearish bias.

NZDUSD: A bearish divergence was found on NZDUSD mid-week and price is expected to post a steady decline to 0.7262. However, we expect to see a near term reversal in prices based on the bullish divergence that is formed. This marks a retracement to the decline and therefore we expect NZDUSD to rally back to 0.74470, which would mark a retest of the broken support for resistance. Therefore short positions are recommended near 0.74470, targeting 0.7262.

Fundamental Outlook

The week ahead will see the US retail sales and inflation figures coming out which will be the last dataset before the Fed meeting the week after. From New Zealand, quarterly GDP data will be coming out over the week, which will be a key catalyst for prices. It is relatively quiet week as far as the euro is concerned, but Mario Draghi is due to speak over the week which is something to keep an eye on. All in all, expect to see some positioning in the markets ahead of next week’s Fed and BoJ meetings which will be major event likely for this month.