Last Friday, the US dollar jumped after Janet Yellen said that the case for rate hike had strengthened. This led to a strong rally in the USD leaving many USD crosses vulnerable and posting strong losses. In the coming week, I expect the dollar strength to continue but we could see a pull back to the trends first. The instruments presented below offer the high likelihood of this to happen. I also present a brief technical and fundamental outlook as well.

The question whether the US dollar will see a follow through and continue to rally higher. The technical landscape for some of the instruments outlined here shows a near term pull back before the trends resume. Therefore it is quite likely that the US dollar will continue rising into this coming week.

Technical Outlook

USDCHF: Price gained rapidly and in the process I have a bearish divergence. The reversal area is identified near 0.98200 – 0.9800. Watch for a reversal renko in this region for a pull back in USDCHF to 0.9730 followed by 0.9650. Short positions are recommended only after a reversal box is formed in 0.9820 – 0.9800.

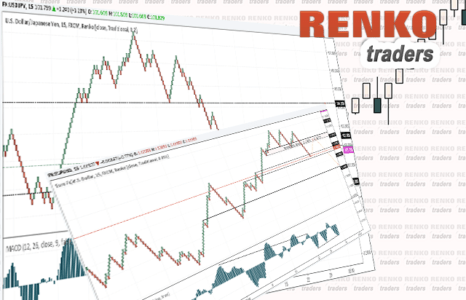

USDJPY: I have a hidden bearish divergence forming currently with the lower high in price and higher high on the oscillator. Look for potential reversal near 102 – 102.2 before USDJPY will fall towards 100.80 – 100.70. Look for long positions from 100.70 – 100.80 for a rally back to 102 and 104.20.

XAGUSD: There is not much to see in gold, but silver has formed an interesting pattern. We see a double bullish divergence near 18.50 which indicates a potential upside correction. At the very least, silver prices could rally towards $19.745 (rounding off to 19.50). In terms of risk reward this is also very good as a break down below 18.52 will invalidate the set up.

Fundamental Outlook

Economic data from the eurozone, Switzerland and Japan are fairly quiet, so most of the currency moves will come from data from the United States. Monday is slow and the US session will see the release of the PCE data. This could be important as we will see July’s PCE inflation figures. In June, core PCE was at 1.60% and forecasts point to a dip to 1.50% in July. Anything below 1.50% could send the dollar weaker even more.

However, the big theme will be this Friday’s US nonfarm payrolls report which is expected to show around 180k jobs added in August. This is slightly lower than the 250k+ number we saw for July. However, the unemployment rate is expected to fall to 4.80%. All in all, if the technicals are right, then expect a strong NFP print that could keep the dollar well supported to the upside.