The British pound continued to remain volatile over the week after on Tuesday the Supreme Court ruled that the British government must put the Article 50 to a parliamentary vote before it can trigger the same. The British government was quick to respond by tabling the bill already and it will be up for debate this coming week.

On the economic front, the UK’s advance GDP report showed that the economy expanded at a pace of 0.6% in the fourth quarter which was slightly higher than expected and surprised the markets at large which continue to expect to see a slowdown in the British economy. In the U.S. the advance GDP report was a bit disappointing at the economy was seen expanding at a pace of 1.9%, slower than the forecast 2.1% growth.

The quarterly inflation report from Australia and New Zealand showed a mixed response. In Australia, inflation continued to remain weak while in New Zealand consumer prices were seen rising strongly in the fourth quarter putting the annual inflation rate to 1.3% right within the RBNZ’s band of 1% – 3%. However, the RBNZ is unlikely to act on the inflation data this soon.

Technical Outlook

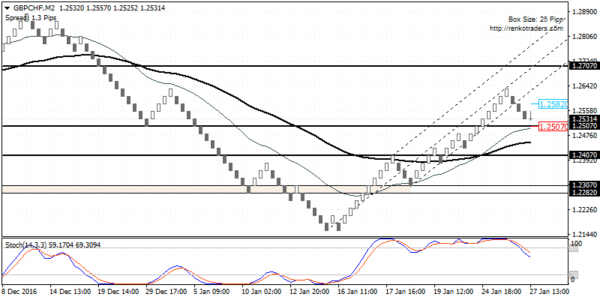

GBPCHF: GBPCHF rallied sharply last week breaking above the first target mentioned at 1.2507 with the 20/50 EMA showing a bullish crossover. However, watch for a reversal as GBPCHF breaks to the downside from the rising median line. Support at 1.2507 will be tested to the downside but price could bounce back higher to retest the break out level near 1.2582. Thus in the short term, look to sell GBPCHF around 1.2582 targeting 1.2507 followed by a further correction towards 1.2407. Also watch for a potential bearish divergence that could be forming on a rally back to 1.2582 which will be the confirmation required.

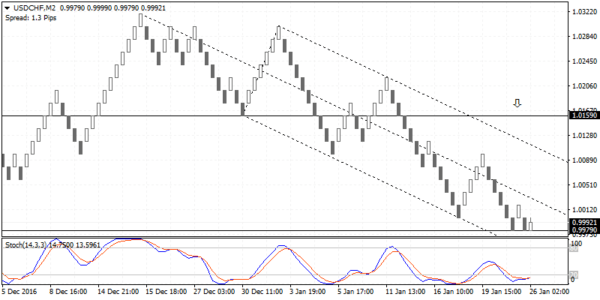

USDCHF: USDCHF has posted a double bottom at 0.9979 and the recent declines have been sharp enough to warrant a correction towards 1.0159. The Stochastics shows a bullish divergence which also validates the view to the upside. Therefore, long positions are ideal on a close above 1.0019, targeting 1.0159. To the downside, a break down below 0.9979 could send USDCHF lower towards the next support at 0.9938.

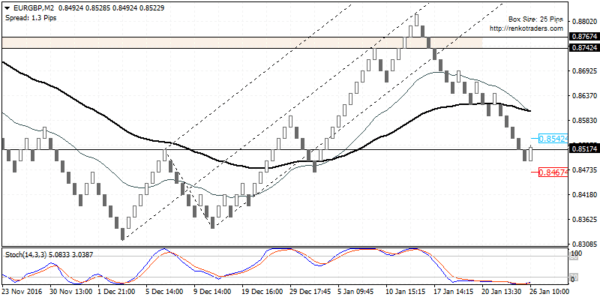

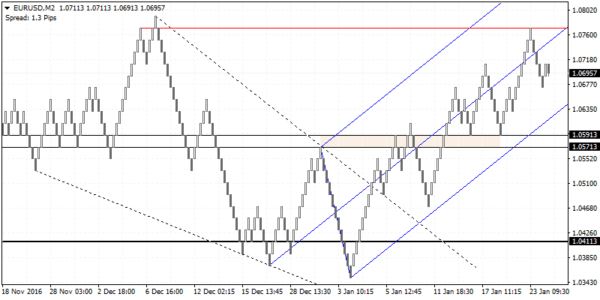

EURUSD: EURUSD is likely to push lower in the coming days following the rally after the breakout from the falling wedge pattern. Support at 1.0591 – 1.0571 is quite likely to be tested to the downside following the median line failure. There is also scope for EURUSD to form a head and shoulders pattern which could be seen with the neckline support slowly taking shape. A bounce off the neckline support at 1.0591 – 1.0571 could mark the formation of the right shoulder which could eventually put EURUSD lower towards 1.0411.

Fundamental Outlook

The week ahead will be busy with the start of a new trading month. Central bank meetings from the BoJ, BoE and the FOMC will be coming up this week but no changes are expected from either of the central banks. However, watch out for FOMC which could signal when the next rate hike will be coming while the Bank of England could remain on the sidelines. The central bank meetings will no doubt add some volatility to the markets this coming week.

On the economic front, the U.S. labor department will be publishing the payrolls report for January alongside other key indicators including the ISM manufacturing and non-manufacturing PMI reports, which could keep the U.S. dollar volatile. However, from a broader perspective, it is quite likely that the data this week will support a stronger greenback.