No matter what you do, having the right tools is essential to the success of your goal.

Likewise in forex, having the right set of tools, be it a trading platform, charting platform, or indicators is essential.

Indicators play a major role in day trading. Because this short term trading is speculative in nature, traders need the correct tools to help them trade successfully.

There are many indicators available for traders today.

In fact, today’s trader is spoilt for choice.

Gone were the days of manually calculating the indicators. Even the simple moving average had to be calculated by hand.

With technology, traders no longer need to learn the inside workings of a trading indicator.

On the contrary, what we have today is a trader who is interested to find the best indicator to trade forex with.

But searching for the right indicator for a profitable strategy is an art in itself.

If only it was as easy as blindly picking up a trading indicator and expecting it to work.

Trading indicators and renko strategy

When you are using the renko chart, it is essential that you pay attention to the kind of indicator you will use.

Not all indicators work and this is where things start to get complicated.

While you can blindly use an indicator that worked with candlestick charts, it may not give the same result when using it on a renko trading system.

In the subsequent parts of this guide to choosing the best indicator for renko, you will discover a few things. It will also answer the question as to why a particular indicator you are using is not working with a renko trading system.

Why should you carefully choose an indicator to trade renko charts?

Renko charts are unique. But this type of chart is not that unique that it requires an exclusive indicator.

Renko bricks are built out of price. This is the very same price used in candle stick charts, bar charts, kagi charts and many more.

With price being the common factor, most indicators that you use in a regular trading strategy also works with renko. I have made the word most in bold, for a reason.

The reason is that when traders use candlestick chats, the indicators can easily adapt. Whether you are looking at the long term charts or short term, the candlestick charts price remains the same.

The only aspect that changes is the indicator re-drawing itself to the price movement based on the time frame you are using. But this changes when you start using a renko chart.

So before we set about answering this question let’s look the indicators that will not work with renko charts.

Why you should never use these indicators in a renko trading system

As you know, a renko chart does not consider time.

A renko brick only uses price. Therefore, only few types of technical indicators can work with a renko chart.

You can already guess where we are heading with this. Trading indicators that use time as a consideration will not work with renko charts. So you need to reject them outright.

Here are a few examples of such indicators.

Volume based indicators don’t work on renko chart

Volume indicators like volume profile or the volume bars that you see at the bottom of your trading screen are useless on a renko chart. Volume is the total number of contracts or shares bought or sold during a period of time.

For example, if a stock price had a volume of 5 million a day, it accounts for the time period, which is the day.

Because the renko brick chart does not consider time as a factor, volume indicators are pointless to use.

In the chart below, we use renko bricks. We also apply the market profile indicator, and also the traditional volume bars.

While the indicator displays some information, it is not relevant to the bricks in question.

Traditional candle stick pattern indicators

This goes without saying! Traditional candle stick patterns like doji will never occur on a renko chart. Similarly, inside bars and outside bars or pin bars are some other examples.

These patterns are unique to the type of forex trading chart being used. Therefore, you cannot expect an indicator that spots candle stick patterns to work with renko charts.

There may be many other examples, but by now you get the idea. Any time based indicators, or a specific chart pattern indicator won’t work with renko.

How to find the best indicator to use with renko trading?

Finding the right indicator to use with renko requires you to follow three steps.

- Identify your style of trading

- Ask whether you will scalp or swing trade

- Find the purpose for the indicator

You don’t need to spend a lot of time to find the “best” renko indicator.

You can build a simple renko strategy using moving averages and make it into the best trading system using renko.

The difference is in the approach. You should have the knowledge and the skillset to make a renko trading system to be profitable.

To find a profitable renko indicator, follow the three steps below.

#1. Find your trading style

Different forex traders have different styles of trading. Some like breakout methods, someone else might like momentum or a trend strategy.

Due to the unique trading methods involved, your choice for a renko indicator also changes.

If your trading style is trend following, then use indicators like moving averages for renko trading.

A moving average indicator uses only the Open/high/low/close or a combination of these variables. And these variables are also available on a renko brick chart. So, a moving average indicator works with renko trading.

You can also use other indicators such as trading oscillators:

- Stochastics oscillator

- RSI

- MACD

- ADX

- etc..

All these oscillators work good because they use price as the variable.

But if your trading style is price action, you will need to look at other ways to trade. You can use support and resistance (using horizontal lines) to trade renko charts. Similarly, trend lines also work with renko.

Knowing your trading style allows you to filter to a few profitable indicators that you can use on a renko chart.

#2. Do you trade long term or short term?

Are you a day trader or a swing trader?

Depending on your answer, you will understand what your daily trading goal may be. A day trader can target 10 pips a day when they use renko chart. But a swing trader or a long term trader may target 100, or 200 pips over the span of a few days.

This question depends on what size of the renko bricks you will use. The brick size setting will determine whether you are swing trading or day trading.

Knowing whether you are a long term/short term trader helps. If you are into the longer term horizon, apply the indicators you have filtered out from Step 1.

The indicators you choose should complement your renko trading strategy.

#3. What do you want from the indicator?

Traders view indicators differently. It is all about how one interprets the indicator and the signals.

In this step, you will essentially fine tune your indicator settings to work with your renko chart.

At the end of step 2, you should already have the indicators you are interested to use in your renko strategy. You will also have figured out the renko brick size you will be using.

In step 3, you will try to figure out what each of the indicators need to do for your renko trading strategy to work.

At the end of step 3, you will have figured out what indicator settings to use in your renko strategy.

An easy way is to simply apply the trial and error method. This means experimenting with different renko trading indicator settings.

Depending on the brick size, you will have to increase or decrease the indicator values.

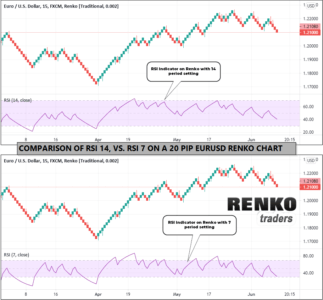

The next renko price chart below compares a 20 Pip EURUSD with settings of RSI 14 and RSI 7.

But as you already know, using too small of an indicator setting can add a lot of noise even though you are using it on a renko brick chart.

Having too large a value on the trade indicator can make it slow to respond to the price changes. It is all about experimenting. So you will need to have a good renko charting platform for this.

What to do after you the find the renko indicator?

After spending a lot of time to find a system that works for you, the question is what next!

Well, you wouldn’t stop right after figuring out what indicator to use. You will need to constantly evaluate the indicator. This is where using a good forex testing software can come in handy.

Be careful of over-optimization. If you adjust your indicator or the brick size, the trading system may work only in certain conditions.

It is at your discretion on how you want to proceed. But do not get intimidated by this. In fact if you went back in time, you would have been using paper and a pencil to tweak your indicators.

You can either have one set of indicators designed to fit a specific size of the renko bricks, or you can focus on two systems, one that works when the market is flat, and the other when there is a trend.