This renko trading strategy based on the equidistant price channel tool is a pure price action trading method which involves buy and sell signals based on price interaction with the equidistant price channel. There are many different variations to this trading approach and it eventually comes down to how good the risk reward set up is, that determines the success of the trades.

The equidistant price channel trading on Renko charts requires a bit of subjectivity and more importantly, the ability to plot the price channel in time to catch the reversals. While this might put off non-discretionary traders, with enough practice, drawing the equidistant price channels can be simple enough.

This price channel trading strategy is a short term strategy and attempts to catch the short term reversals in a trend. It is a counter trend method and identifies short term reversals within the trend. Therefore, traders need to keep an eye on the prevailing trend as well (which you can identify by using moving averages or simply determining the trends by means of price action).

Equidistant Price Channel Indicator

On most charting platforms such as Tradingview.com, you can automatically select the equidistant channel tool from the drawing section. The Parallel Channel is found under the second group to the left side of your screen.

On MT4 trading platform, the default price channel indicator has its short coming as there is no median line shown. To overcome this, we make use of the Fibonacci channel, which can be found by going to Insert > Channels > Fibonacci.

To configure the Fibonacci channel, plot the channel on the chart and then double click the channel which opens the properties window. Click on ‘Fibo Levels’ and delete all the levels. Type in -0.5 in the level and click ‘OK.’

By doing so, you get the outer price channel lines and the median channel line.

Drawing the equidistant price channel

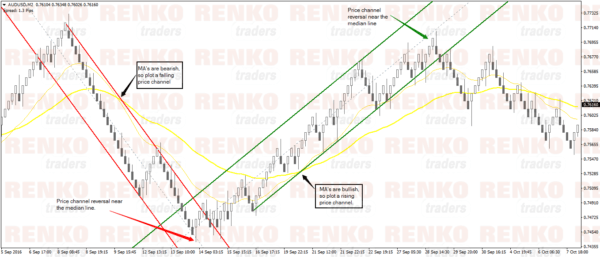

The first step is to understand the trend. Are prices going up or down? Once you answer this question, based on how the moving averages are lined up on the chart, the next step is to plot the price channel in the direction of the trend.

Now once you have the price channel plotted, the next step is to wait for the reversal confirmation which we will discuss in the next section.

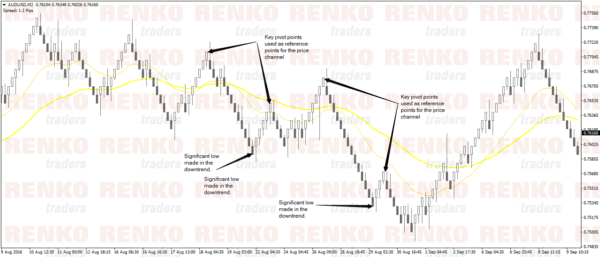

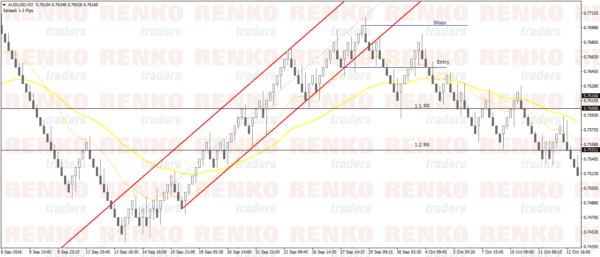

To plot the price channel correctly, the next step is to look for key pivot reversal points. Once you identify these pivot points (we need only three. Two lower highs and one lower low in a downtrend, two higher lows and one higher high in an uptrend), you can then connect these levels using the price channel.

You can see this in the next chart below.

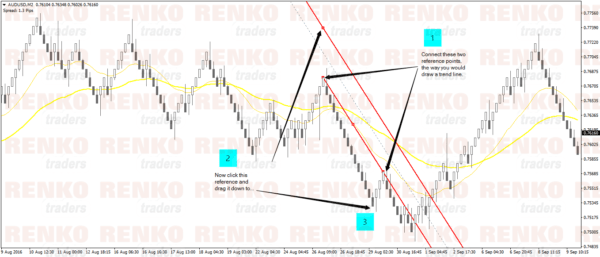

Click on the third reference point and drag it down to the third reference point which will bring the median line onto the price and make the channel more meaningful.

Price Channel Reversal Set up

There is just one simple pattern to look for when anticipating a reversal.

Look for a Renko reversal near the median line. Now this doesn’t happen all the time, but bear in mind that the signals are much stronger when there is a reversal Renko bar near the median line. In some cases you will find the reversal to occur near the upper price channel (in a downtrend) or the lower price channel (in an uptrend).

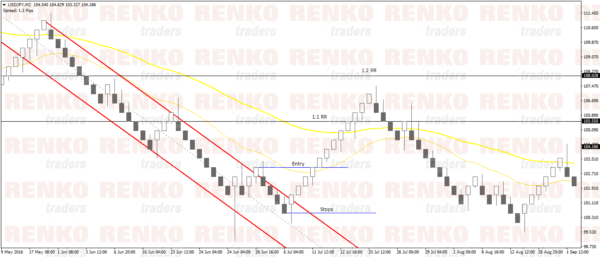

The next chart shows this reversal set up clearly.

You cannot expect to get the perfect reversal all the time and sometimes price tends to rally or fall sharply, as shown in the next chart below. In these instances, you just stay out of the market.

This is shown in the next chart.

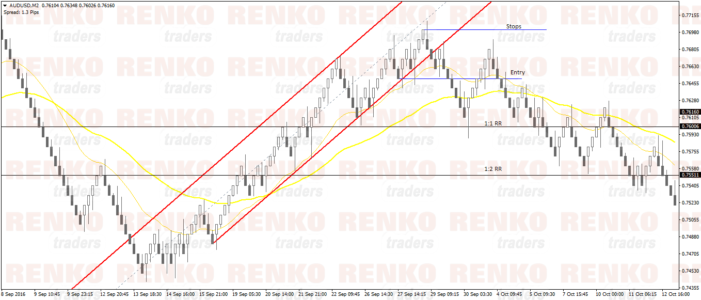

Setting your entry, stops and target levels

Assuming that you have the most ideal reversal on the median line of the price channel, the next step is to plan your entry.

In a downtrend, look for the most recent high that was formed before the reversal. Set your long positions at this level and your stops at the reversal close (near the median line). Set your target for a 1:1 RRR and a 1:2 RR. When the first trade’s target is reached, move the stop loss to break even for the second trade.

Equidistant price channel trading strategy – An open ended system

The equidistant price channel trading strategy on Renko charts is pretty much an open ended trading system. You can either trade based on the above mentioned rules, or you can add your own validation and trade management set ups. For example, one of the ways to find a very good set up is to look for a double top or a double bottom pattern formed near the median line, which can result in some strong profits.

To be successful in trading with the equidistant price channel trading strategy on Renko charts, you need to have some patience and wait for the right conditions to occur in order to trade. Overall, if you like price action trading, this strategy has something to offer.

And finally, here’s the video that puts together this tutorial and demonstrates how you can trade the Price channels on Renko.