The Median line is known and proven to be a versatile tool when it comes to trading with price action. One of the distinctive advantages of applying Median line (also known as Andrews Pitchfork) tool price charts is the fact that it comes with a strict set of criteria.

When combining these rules to the price action in Renko charts, traders would be able to trade the markets with relative ease. It does however require the trader to be knowledgeable in price action and trading off support/resistance.

In this article, we do not go into the details of the Median line and assume that the reader is already well versed in using this tool.

Median Line (Andrews Pitchfork) Trading Rules

Before go into applying the Median line analysis, it is best to recap the rules laid out for using this tool.

To plot an upward projecting Median line, traders need to connect three alternating swing points, which is Low, High and Low. Similarly, when projecting the Median lines in a bearish market, the alternating swing points of High, Low and High are needed to construct the median lines on Renko charts.

After the Median line is plotted on the chart, the next step is to watch for any of the Andrews Pitchfork rules to qualify for a trading signal.

The Median line rules can be summarized as follows:

- There is a high probability that price will reach the latest Median Line

- Price will either reverse at the Median line when it fails to zoom through or cut the median line with strong price action. When price action consolidates near the median line it indicates that prices could fall back or rally to the closest outer median lines

- When price cuts across the median line, it often retests the median line before reaching one of the outer median lines.

- Price can reverse near the Median Line, or the Upper/Lower Median lines (same rules of consolidation for reversal/cutting across for trend continuation holds true)

Applying Median Line to Renko Charts

There are two ways to apply or plot the median line on renko charts.

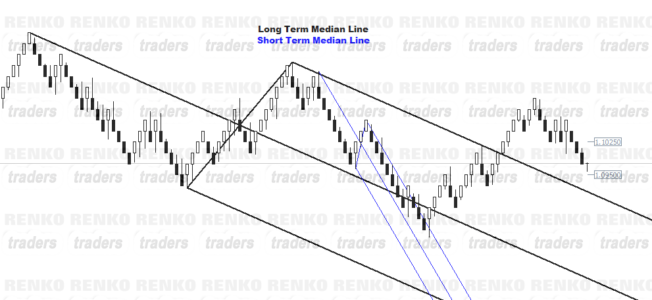

- Long term median lines, which considers major swing points

- Short term median lines, which considers small swing points within a major trend

Although there are no major differences, a trader could combine both these methods into developing a good trading plan or to gain an understanding of the price action. The following chart below plots a combined long term and short term median lines. If you observe closely, by combining two median lines, traders will notice how/why price action has been behaving the way it was as well as the below analysis would have given quite a few trading opportunities.

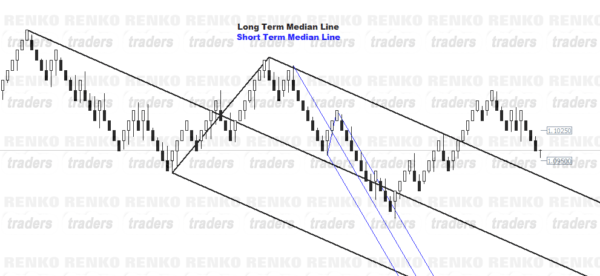

Observations from the above median line analysis

- Price action consolidates near the major (long term) median line thus pointing to a possible reversal to the outer median line

- Plotting the short term median line, we see that price fails to reach the median line and instead consolidates near the upper median line

- When price breaks out of the short term (blue) median line, price rallies for a while, makes a brief dip before rallying towards the Long Term median line’s upper median line

- Furthermore, on the current price action to the right, we also notice that a retest on the upper median line is currently taking place and thus a bullish continuation is likely to happen

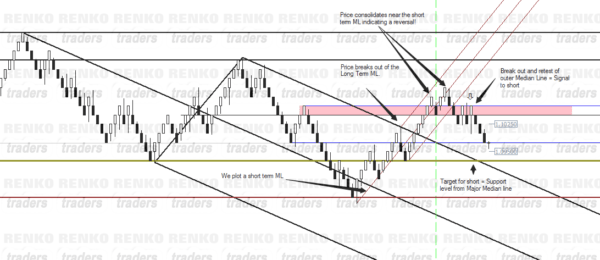

Plotting Support and Resistance using Median lines

The Median line, besides the above rules is also useful in helping traders to identify potential support and resistance levels. In order to spot these, you simply add a horizontal line to each of the three swing points used to plot the median line.

The next chart below shows a combination of plotting support/resistance levels and using the short term median lines as a trade signal trigger as well. Please go through the chart carefully which also has notes on the chart indicating the behavior of the price action.

We added a new short term median line (in Maroon) and removed the previous short term median line (in Blue) in order to keep the chart simple. However, the thin blue horizontal lines are retained which indicate the short term support/resistance levels.

As we can see from the above, the median line tool can be a great way for traders who wish to trade only with price action. The analysis is quite similar and retains the same elements as you would apply the median line to regular price charts. The median line analysis can become especially powerful when combined with the price action on Renko charts as well as other types of Renko including Median Renko.