In the previous article, we covered the basics about the Median Renko charts and also illustrated some differences between the median Renko charts and the traditional Renko charts. With a clear understanding of how the Median Renko charts work, in this article we illustrate a rather simple trading strategy.

(Learn: Median Renko Charts)

This trading strategy is aptly titled, “Median Renko Engulfing Bar Strategy” and is used specifically with the Median Renko charts. The success of this trading strategy relies primarily on the basis that trends are are a lot more easier to be visually identified with the median renko charts.

The Median renko engulfing bar strategy is also a very short term (scalping) strategy. Therefore, the trader doesn’t need to focus on the long term, let alone the medium term trend in the markets. As and when signals are generated, we enter and exit the markets with a few pips of profits in the pocket.

As with any scalping strategy, it is very important that the risk/reward ratio is also clearly defined in order to protect the account equity from prolonged or continuous losses.

As such, bearing this in mind, the Median Renko engulfing bar strategy employs a strict entry/exit rules which includes both the stops as well as take profit levels.

Median Renko Engulfing Bar Strategy – Chart Set up

For the charts, we make use of the Median Renko Charts, which can be downloaded from here.

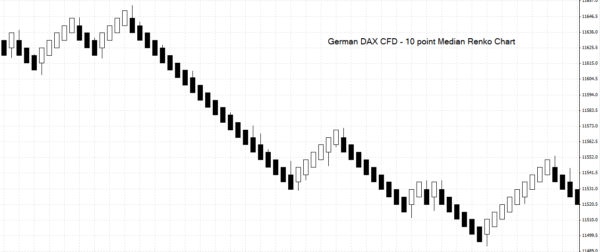

Based on the instrument or market that you wish to apply this trading strategy to, the pip size can be changed. For the majors, a pip size of 20 – 50 should suffice and for trading indices, a 100 pip (or a 10 point) box size is very ideal.

We leave the remainder of the settings as is, meaning that we use the 50% reversal point for the median Renko charts.

Once the indicator is set up and the offline chart generated, your chart should look like the one below. Note that we don’t use any indicators such as moving averages or oscillators in this trading strategy.

Buy & Sell Rules – Median Renko Engulfing Bar Strategy

For the buy sell rules, we simply look for engulfing bars. For the sake of clarity, an engulfing bar is one whose highs and lows completely engulf the previous bar. There has to be no spike in any direction with the previous median renko bar.

The chart below shows a few such examples of weak and strong engulfing bars.

So to summarize, we only look for strong engulfing bars with the Median Renko chart.

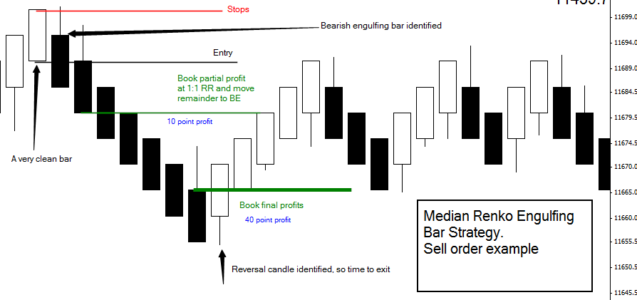

Once we identify the strong bars, we place a pending sell order at the low (or the high) of the previous bar with stops at its high (or the low). Two units are opened, where the first position is closed at 1:1 risk reward while the second position trades at break even as long as there are no opposite signals generated.

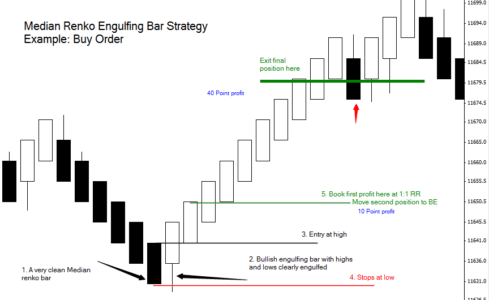

The first chart here shows an example of a Buy Order set up using the Median Renko Engulfing bar strategy.

Click on the picture above in order view the notes on the chart. The basic essence of the above example can be summarized as follows:

- Identify a clean Median Renko bar (with no wicks)

- Wait for the next Median Renko bar which engulfs the previous bar

- After the engulfing bar closes, place a pending buy order at the high (high is always equal to open) with stops at the low (close)

- Book first profit at 1:1 risk/reward (i.e: 10 point profit)

- Move the stops to break even for the second position and exit only when an opposite color median renko bar is printed

The next chart below illustrates a sell example. It works in the same (but opposite) way as the above ‘Buy Example’.

As you can see from the above ‘Sell Order’ example, the principle is the same but opposite to the Buy order.

Median Renko Engulfing Bar Strategy – Pros and Cons

This strategy is actually quite robust and comes with a tight stop loss (5 points or equivalent stop loss). By booking partial profits at 1:1 risk reward, the remainder of the trade is left open to move risk free. In most cases, traders can use this second ‘risk free’ position to take as many pips as possible before a reversal candle is printed on the chart.

This strategy is beneficial for traders who merely want to make money and do not want to bother too much with the trends or other market factors. There is also no requirement for traders to consider other variables such as indicators or even fundamental factors.

In the above examples, we have illustrated this simple yet robust strategy that losses only 5 points in the German DAX. Of course, this can be applied to the currency markets as well and works just the same. However, in terms of having an edge, always choose a market and set your Median Renko box size such a way that it doesn’t get too choppy. This means, having to spend a little time experimenting with different Renko box sizes.

(Tip: While selecting/experimenting with the Renko box size, make sure you take into consideration the spread of the instrument as well.)

However, once the hard work is done, I’m sure the Median Renko engulfing bar strategy will actually be fun trading.