The Renko MMA strategy could possibly be termed as the most simple short – medium term trend following strategy. As the name suggests, this strategy employs a moving average and a momentum oscillator.

The strategy, when used correctly (read as being patient for entries) can offer some great risk/reward set ups and practically allows you to “let your winners” run.

At the heart of this strategy is of course money management. In order to best use this strategy, a trader needs to follow strict discipline. The best results come from trading or focusing on two pairs at the maximum at any time.

Renko MMA Chart Set up

In order to use this strategy, you will firstly need to have a Pro subscription to Tradingview.com charts (Click here to read more about Tradingview Renko charts). The Pro subscription enables you to make use of intraday Renko charts.

So, for this strategy, we make use of 1 hour Renko charts with a fixed box size of 0.0025 – 0.005 pips (25 – 50 pips) renko box size.

- Exponential Moving Average period 20, set to close

- 20 period momentum indicator with 0 – line

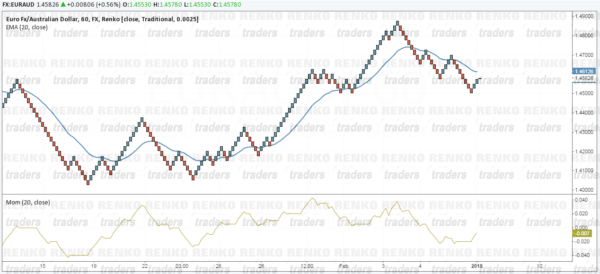

Your chart looks as follows when you have the set up ready.

Renko MMA Strategy – Trade Set ups

For Long positions

- Wait for price to move above the 20 period EMA (or wait for momentum to rise above 0 – line)

- Next, wait until a high is made above the 20 period EMA and then you see a decline (or a dip). This forms the trade set up

- If price is still above the EMA and momentum is either at 0 or above the 0 line, then place a pending buy order at the closing price of the high, with stops at the recent/previous low

- Initial RR is set to 1:1, following which the trade’s take profit is trailed along the 20 EMA

For Short positions

- Wait for price to move below the 20 period EMA (or wait for momentum to fall below 0 – line)

- Next, wait until a low is made below the 20 period EMA and price starts to retrace a bit. This forms the trade set up

- If price is still below the EMA and the momentum is either at 0 or below the 0 line, then place a pending sell order at the low with stops at the previous high

- Initial RR is set to 1:1 after which the trade’s stop loss level is trailed along the 20 EMA

Renko MMA Strategy – Trade Examples

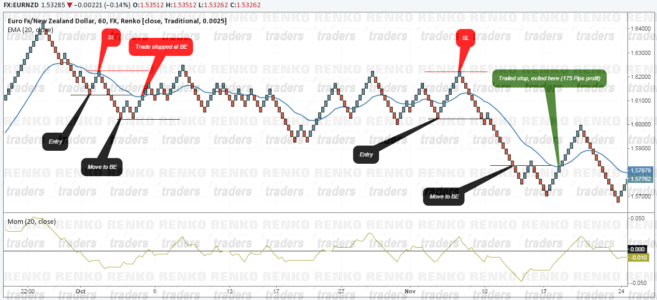

Long set up

The chart below shows the long trade example using the Renko MMA method.

- This is a fake set up as price rallied too quickly making a high far away from the previous low as well as the 20 EMA. Although this trade would have worked as a longer term set up, we ignore this.

- Price breaks 20 EMA by 25 pips and then retraces. We wait for momentum to be either at 0 or above, to enter. The long position is entered with stops near the previous low.

- After the long order is triggered, we then move trade to BE after price moves in equal distance to the original risk. The trade however ends at exiting at break even

- Trade 4 offers a new long set up that results in 175 pip profit

- Trade 5 also results in a profit of 100 pips

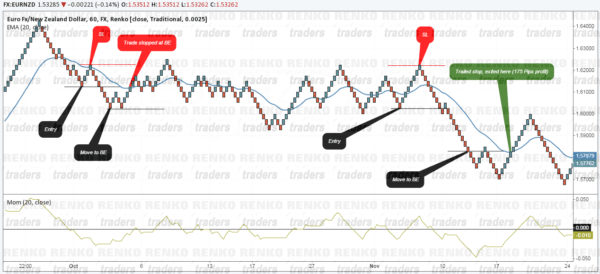

Short Set up

The chart below shows examples of short set up using the Renko MMA trading strategy.

- The first trade we notice meets the criteria as we enter short on the low. Price then moves in equal distance to our stop loss and we move the trade to break even. Price rallies back and results in hitting the stop loss at break even position

- The second trade shows a sharp break of the EMA and then a rally. A pending sell order is placed at the low with a 1:1RR. Price reverses back below the 20 EMA, triggers the trade and moves beyond the 1:1 RR. We then trail the stops along the 20 EMA, resulting in a total profit of 175 pips

Renko MMA Strategy – Conclusion

The Renko momentum and moving average strategy is simple and trades in the direction of the trend. For best results, always keep an eye on the slope of the moving average. A retracement on the slope offers the best trade set ups. While this will take time with enough practice, traders can train their eye to also focus on the EMA slope, thus keeping them out of false entries.