Based on the weekly technical report from last week, we expected to see a pull back in the US dollar. It did not occur for the most part and even after last Thursday’s weak ISM manufacturing report and a rather soft NFP report, the US dollar managed to hold its ground. This has however not changed the view and we continue to expect the US dollar to see some near term weakness.

The week ahead is relatively quiet with no major releases of important. The US markets are closed on Monday and Tuesday we get to see the ISM’s non-manufacturing report. But, according to forexfactory.com an early leak showed a weaker non-manufacturing PMI print, which could keep the downside pressure on the USD.

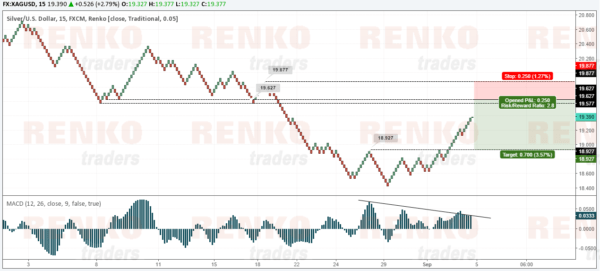

From last week’s technical outlook, we managed to make some profits. Mostly on Silver’s bullish run, which actually was flat for the most part and some significant moves coming only around Thursday and Friday and that too with a lot of hesitation.

This week’s technical outlook continues to follow on the same instruments. EURUSD, USDCHF, USDJPY and Silver.

Technical Outlook

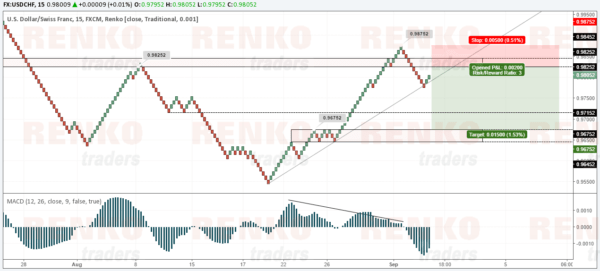

USDCHF: From last week’s technical levels, prices bounced around but we are finally seeing signs of a correction. The chart below shows a potential short position in USDCHF as prices move back to retest 0.9825. The short position is invalidated if it moves above a certain level mentioned on the chart. To the downside, watch for the correction to end near 0.9675 with partial profit book at the level shown on the chart.

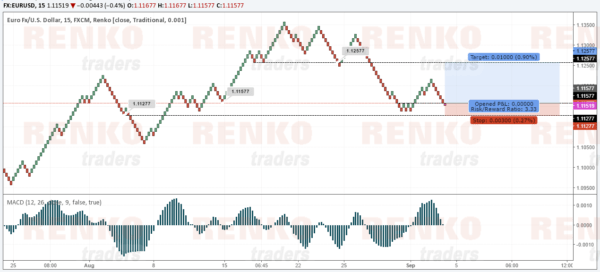

EURUSD: There was some bounce off 1.1157 but prices soon fell back by Friday’s close. This retest back to the support level could mean that the euro has some upside left in it. We expect the euro to correct to the level shown on the chart after which we can see some downside coming into the picture. The long positions are a near term trade set up.

XAGUSD: Silver prices rallied strongly and we expect the bullish momentum to continue. Watch for a potential hidden bearish divergence near the resistance level noted on the chart. Taking short positions off there is ideal for Silver prices to move back lower to 18.927.

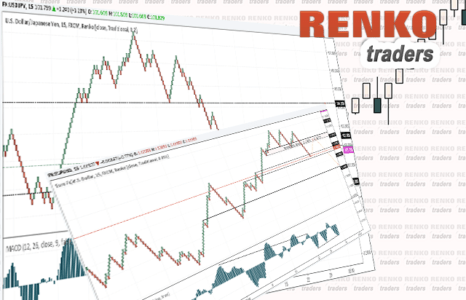

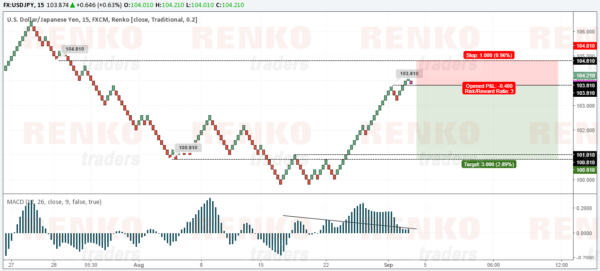

USDJPY: Prices remain hovering near the 103 – 104 region, but the bearish divergence indicates a sharp pull back. We expect this near term pull back in USDJPY to prepare the stage for a long term rally. Short positions at the levels mentioned on the chart make for a good set up targeting 101.01 – 100.810.

Fundamental Outlook

Traders will be focusing on the ECB’s meeting this week. The central bank is unlikely to make any big changes but watch for potential hints at future prospects on expanding QE and also the economic projections from the ECB. For the Swiss franc, watch out for the speech by SNB chairman, Thomas Jordan. In the US, it is going to be a short week with Monday closed due to Labor holiday. The ISM’s non-manufacturing PMI was leaked ahead of time but there is still scope for a surprise. Overall, volatility should be quiet this week although the dollar might look for some re-pricing as the markets remain doubtful for a Fed rate hike in September.

Last but not the least, BoJ’s Kuroda will be speaking earlier in the week and Japan’s second quarter GDP data will be coming out as well. Yen has weakened strongly over the past two weeks so maybe it is time for a correction.