This article is an update the previous AUDCAD Renko technical analysis. We are still of the view that the market is positioned to the downside and expect a confirmation to show up either by end of day today or by Friday’s close.

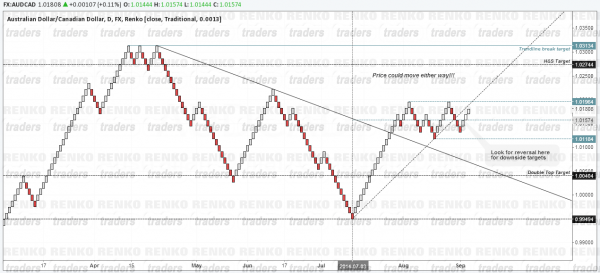

The renko chart below paints a complete picture with both upside and downside potential price movements. There are a lot of things happening on the AUDCAD renko chart. So let’s take a look at each of these individually.

Starting from the extreme right, we have a double top pattern long with the “W” pattern, which indicates bearish price action. The double top pattern gives a downside target to 1.00404.

On the upside, the risks come from the fact that we have a trend line break formation with the low at 1.01184 testing the trend line break out. This pattern gives us an upside target to 1.03134, which incidentally is a strong resistance identified by the previous successful triple top pattern.

However, for this to happen, the double top pattern must first be broken. There is also what seems like an emerging inverted head and shoulders pattern giving a target to 1.02744

Considering all the above, we have to see a confirmed daily close above 1.01574 which will be the first indication of a change of bias.

When we look to the traditional candlestick patterns, we can get a more clearer understanding of AUDCAD price action.

The picture below shows the AUDCAD daily charts with the Median line which was recently broken and retested but failed to break the previous swing high.

Within the break of the median line, we find AUDCAD to be moving through a down sloping channel which is indicative of a bullish flag that is emerging. The target of 1.00404 happens to the middle of this channel and also a key support level that was previously tested. Keeping the above in mind, existing short positions in AUDCAD can be reduced if we see today’s candle closing above 1.01574. On the contrary, failure to close above this price level could see a bit more consolidation or tight price action in play until tomorrow’s NFP data after which we will get a very clear picture of AUDCAD’s direction.