The Canadian Dollar, Japanese Yen currency looks ideal to trade as it signals a potential change of trend in the short to medium term. In the chart below, we analyze CADJPY based off the two trading strategies mentioned, namely the Trend line break method and the Renko MMA trading strategy.

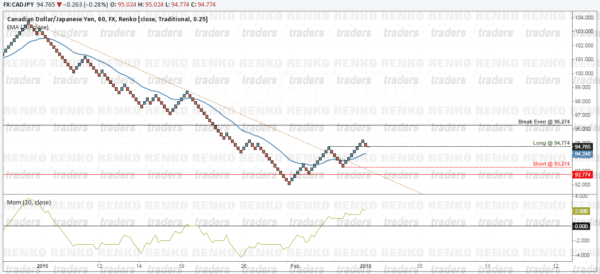

The chart below shows a 25 pip fixed box size renko charts for CADJPY. Plotting a trend line connecting the highs, we notice that price recently broke out from the falling trend line near 94.524 levels but immediately dipped lower.

This leg to the downside was however well contained above the previous bottom at 92.024, indicating a change of direction. The result was a break out from the trend line with current price action looking to retest the break out levels.

Using the trend line break method, we initial see two price levels, one at 94.774 and the second, a bit lower at 93.774, both of which seem to be valid retracement points.

When analyzing the CADJPY renko chart in relation to the Renko MMA strategy, we notice that the price point at 94.774 makes for an ideal long entry, while stops would naturally be placed near 93.274.

Based on the combination of the two trading strategies, we can therefore conclude that a dip to 93.774 cannot be ruled out and in this regards, the stops would be adjusted from 93.274 to 92.774

For the long set up, we will therefore look to enter at 94.774, followed by another entry near 93.774, with stops for both the trades at 92.774. To the upside, the initial break even target would be at 96.274, where we could close the first position (Long from 94.774) while letting the second entry (long at 93.774) moved to break even while trailing stops to the 20 EMA.