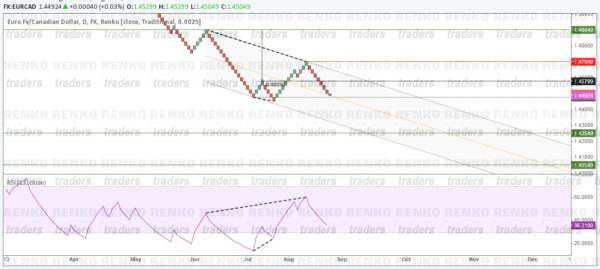

This is a delayed trade signal for EURCAD. A short position was initiated at 1.458 based on a technical trading strategy based off Renko charts. The Renko chart below has 2 confirmations for the bearish trend.

The first clue comes from the “W” pattern formed. You can read more about trading the “W” pattern with Renko charts. The target based on this pattern gives us a price level of 1.42549.

When we apply the RSI to the Renko charts, we notice a clear divergence with price making lower high while RSI makes higher high. Further, a small lower low was made with RSI plotting a higher high, which indicated a correction to the downtrend.

Based on the RSI, we have the next target at 1.40549. New positions could be initiated at 1.44799 with stops at 1.47049 with T1 and T2 respectively.

A channel was plotted to act as a guideline for the price. We currently see price near the middle of the channel, so expect to see a bounce back to 1.45799