When it comes to forex Renko trading system, there are primarily two schools of thought amongst Renko traders. The question is whether to use fixed box size Renko or to use the ATR version of Renko. While there is no right or wrong approach, it is prudent for the Renko trader to understand how each of the above two Renko chart settings takes the trader into two completely different paths. Read this article if you are new to renko charting.

Forex Renko trading system – ATR Based

In the ATR based forex Renko trading system, the Renko charting is typically configured to a 14 period ATR. For example, if the 14 period ATR for EURUSD is 20 pips, then the Renko bricks are constructed based on 20 pips.

After a certain period of time, due to volatility should the ATR change, the pip value also changes, which therefore results in the Renko bricks being redrawn to the new ATR value.

It is very obvious at this point about the issues this dynamic value of the ATR presents. For a Renko trader, this translates to having to change their trend lines, horizontal support & resistance levels to be redrawn to the new Renko bricks. Another factor to consider when using ATR for Renko trading system is because the Renko’s are not time dependent and if you are already into a trade set up, the changing ATR values could add further confusion to the analysis.

The upside to using ATR based forex Renko chart setting is that the box size tends to depict the current range of price for the instrument.

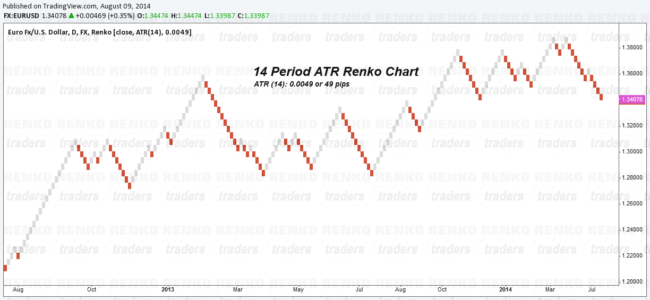

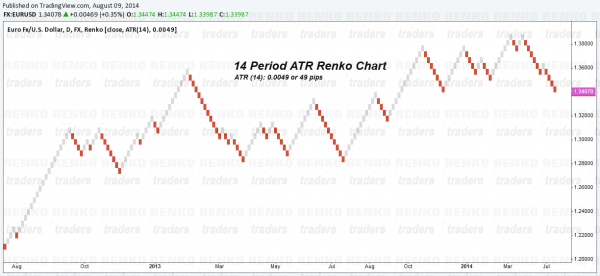

The chart below shows a 14 period ATR Renko charting. The 14 period ATR has a value of 49 pips, which translates to a 49 pip Renko chart. Now if the ATR were to change by a few pips + or -, the entire Renko chart would be redrawn.

Fixed box size Forex Renko trading system

In the fixed box size forex Renko trading system, a constant value is used throughout the lifetime of the Renko chart analysis. The most typical values would be 5, 10, 20, 30 pips and so on. One aspect to keep in mind when using fixed box size Renko chart settings is that the more smaller the box size is, the more sensitive the Renko charts become.

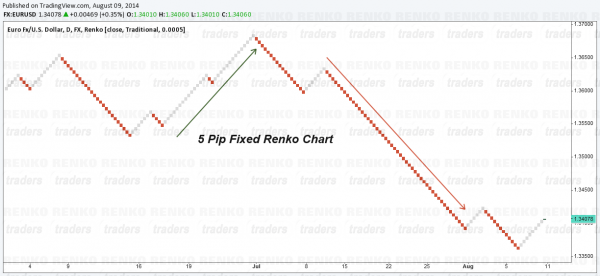

This is best illustrated with the chart below. We take the example of EURUSD Renko chart. The first chart below is that of a 5 pip fixed box Renko. In this chart, we notice how strong the trend is. But at the same time note that, because the pip value is small, the trends shown here should be viewed as a short term trend.

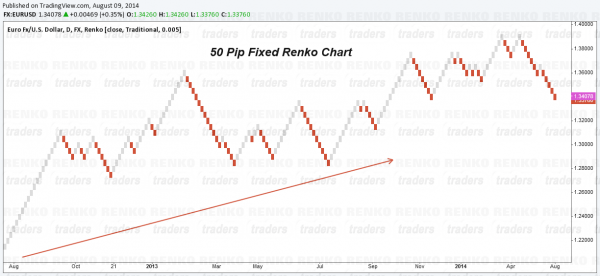

The following chart shows a 50 pip fixed box Renko chart of the same EURUSD pair. Notice how different the Renko bricks are plotted here? Here we see how the uptrend is in place along with major corrections to the uptrend. Comparing this Renko chart to the previous Renko chart, we can see the difference in the charts, which would also warrant us to take different approaches to analyzing the Renko charts.

It is now easier to see the pros and cons of using one of the two approaches to forex Renko trading system.

Besides the two approaches, other ways to configure your forex renko trading system includes settings for High/Low as well. The default fixed pip renko is based on close and is sometimes referred to as ‘Absolute Close‘ configuration as well.

So, which is a better forex Renko trading system?

While both of the two approaches have its own pros and cons, it is basically up to the trader to see what they are comfortable with. My approach to the forex Renko trading system is to use a fixed box size which I feel is valid. Sometimes, chart patterns, support/resistance lines may not be evident. Therefore by being flexible Renko traders would be able to quickly scan the Renko charts and stick to the configuration at least until the trade set up achieves its target. The differences could be perhaps well illustrated in this renko chart price action trading example.